Top Forex Day Trading Strategies

Forex day trading is a fast-paced and potentially profitable way to engage in the global currency markets. However, to succeed in Forex day trading. It’s essential to have a well-thought-out strategy that aligns with your trading goals, risk tolerance, and time commitment. In this comprehensive guide, we will explore Forex day trading strategies. Key elements of successful day trading, popular strategies to follow, and tips to ensure consistent profitability. Whether you are new to Forex trading or a seasoned trader looking to refine your approach, this guide has something for everyone.

What is Forex Day Trading?

Forex day trading involves buying and selling currency pairs within the same trading day, with the goal of profiting from short-term price fluctuations. Unlike long-term investments where trades are held for weeks or months. Forex day traders typically close all their positions before the market closes for the day. This ensures they avoid overnight risk, as currency prices can move unpredictably due to economic reports or market sentiment shifts.

https://www.forex.com/en-us/trading-academy/courses/trading-styles/day-trading-forex/In Forex day trading, traders rely heavily on technical analysis and real-time market data to make decisions. The primary goal is to identify price trends, support and resistance levels, and patterns that can signal potential market moves. Traders aim to capitalize on small price movements within a short period, often using leverage to amplify their returns.

Key Features of Forex Day Trading

- Short Timeframe: Forex day traders operate on short timeframes, from minutes to hours. They focus on quick, smaller profits rather than large moves over weeks or months.

- High Leverage: Many Forex brokers offer high leverage, which allows traders to control large positions with relatively small amounts of capital. However, leverage can magnify both profits and losses, making risk management crucial.

- No Overnight Risk: Since day traders close their positions by the end of the day, they avoid the risks associated with holding positions overnight, such as unexpected news or market gaps.

Key Elements of Successful Forex Day Trading

To be successful at Forex day trading, you need to understand the key elements that contribute to profitable trading. These elements include market analysis, risk management, and discipline. Below, we break down these crucial components:

Understanding Market Trends

A Forex day trader must have a solid understanding of market trends to identify profitable opportunities. Trends indicate the general direction in which a currency pair’s price is moving—up (bullish), down (bearish), or sideways (neutral).

- Trend Following: One of the most widely used strategies in day trading is trend-following, which involves buying in an uptrend and selling in a downtrend. Trend traders often use moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) to identify the direction and strength of the trend.

- Counter-Trend Trading: While trend following is popular, some traders prefer to go against the prevailing trend, expecting a reversal. This strategy requires a solid understanding of market behavior and key reversal indicators, such as candlestick patterns and support/resistance levels.

Risk Management in Forex Day Trading

Effective risk management is arguably the most important aspect of Forex day trading strategies. Day trading can be highly volatile, and it’s easy to get caught up in emotions that lead to overtrading or taking excessive risks. Here are some risk management tips to help protect your capital:

- Stop-Loss Orders: A stop-loss is an order placed with your broker to sell a currency pair when it reaches a certain price. This helps limit losses if the market moves against you. Day traders often set tight stop-loss orders to protect their positions from sudden market fluctuations.

- Position Sizing: Position sizing refers to the amount of capital allocated to each trade. It’s essential to keep your position size consistent with your risk tolerance. Most traders risk only a small percentage (1-2%) of their total trading capital on each trade.

- Risk-to-Reward Ratio: A risk-to-reward ratio of 1:2 or better means that for every dollar risked, the trader expects to gain at least two dollars in profit. This helps ensure that even if only 50% of your trades are successful, you can still be profitable in the long run.

Popular Forex Day Trading Strategies

When it comes to Forex day trading, having a solid strategy can mean the difference between consistent profits and substantial losses. Here are some of the most popular Forex day trading strategies. That traders use to maximize their chances of success:

Trend Following Strategy

The trend-following strategy is one of the most widely adopted strategies by Forex day traders. The idea behind this strategy is simple, trade in the direction of the prevailing trend.

- How it works: In trend following, traders look for currency pairs that are showing clear upward or downward movements. When the market is in an uptrend (bullish), traders buy, and when it’s in a downtrend (bearish), they sell. The goal is to capture profits from extended trends.

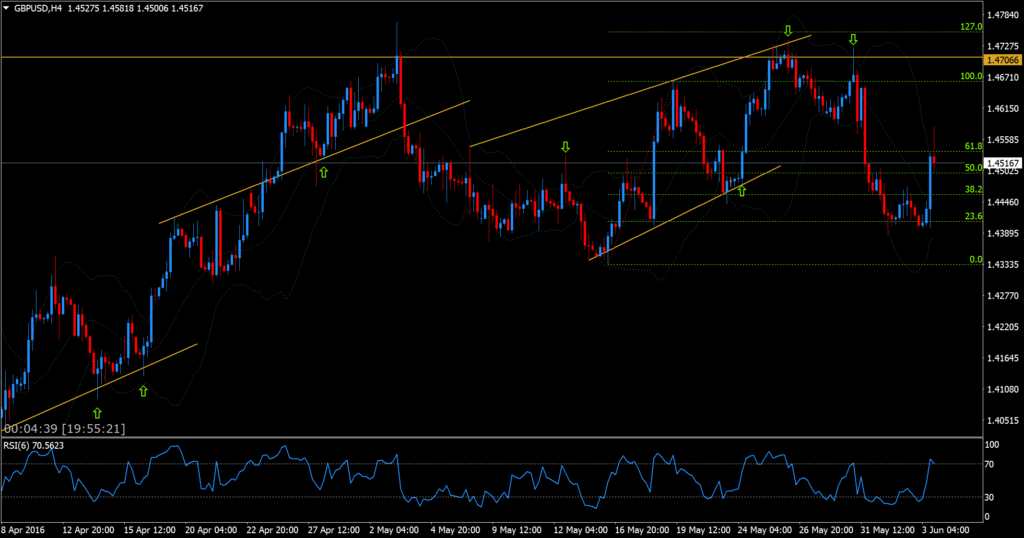

- Indicators to use: The most common tools for trend following include Moving Averages (MA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD). Moving averages help identify the overall trend direction, while RSI and MACD indicate whether the trend is overbought or oversold, signaling potential reversal points.

Range Trading Strategy

The range trading strategy is ideal when a currency pair is trading within a well-defined price range, with clear levels of support and resistance. This strategy focuses on buying at support and selling at resistance, aiming to profit from price bounces within the range.

- How it works: Traders identify horizontal levels of support (the price at which a currency pair tends to stop falling) and resistance (the price at which it tends to stop rising). Once these levels are established, traders enter trades at the extremes of the range.

- Best for sideways markets: This strategy works best in sideways or consolidating markets where the price is moving within a narrow range without strong trends. Range traders rely on chart patterns like double tops and double bottoms to predict when a breakout might occur.

Breakout Strategy

The breakout strategy aims to capitalize on significant price movements after a breakout from a period of consolidation. A breakout happens when the price breaks through key support or resistance levels, signaling that a new trend may be starting.

- How it works: Traders watch for consolidation or a period of low volatility and then wait for the price to break out of this range. Once the breakout happens, they enter the trade, anticipating that the price will continue in the breakout direction.

- Indicators to use: Breakout traders often use Bollinger Bands, ATR (Average True Range), or support/resistance levels to identify breakout points. These tools help traders determine potential breakout points and set their stop-loss orders.

Advanced Forex Day Trading Strategies

Once you’ve mastered the basic Forex day trading strategies. You may want to explore more advanced approaches to further refine your trading skills. Advanced strategies require a deeper understanding of market behavior, psychology, and risk management.

Scalping Strategy

It is an advanced Forex day trading strategy that involves making a large number of small trades over the course of the day. The goal is to capture tiny price movements in highly liquid currency pairs, making small profits on each trade.

- How it works: Scalpers typically aim for profits of 5-10 pips per trade, executing dozens or even hundreds of trades within a single day. This strategy requires precision and the ability to react quickly to market conditions.

- Best timeframes for scalping: It is usually trade on very short timeframes, such as 1-minute or 5-minute charts. They often focus on major currency pairs like EUR/USD, GBP/USD, and USD/JPY. As these pairs offer high liquidity and tight spreads.

- Tools and indicators: Scalpers often use moving averages for trend direction, Stochastic Oscillator for overbought/oversold signals, and volume indicators to confirm trade entries.

News Trading Strategy

News trading takes advantage of market volatility caused by major economic events. Such as central bank announcements, employment reports, and geopolitical events. News traders attempt to anticipate market reactions to news releases and use that information to enter profitable trades.

- How it works: News traders watch the economic calendar for key reports, such as non-farm payrolls, interest rate decisions, or GDP data. They enter trades before, during, or after the release, depending on the expected market reaction.

- Understanding news releases: Successful news traders need to understand how different news events can impact currency pairs. For example, a strong jobs report might cause the currency of a country to appreciate. While a weaker-than-expected GDP report could weaken the currency.

Price Action Trading Strategy

Price action trading is an advanced Forex day trading strategy that focuses on analyzing raw price movements. Rather than relying heavily on indicators.

- How it works: Price action traders analyze candlestick patterns, such as Doji, Engulfing Patterns, and Pin Bars, to identify potential entry and exit points. They also look for key levels of support and resistance, trendlines, and channels to make trading decisions.

- Advantages of price action: One of the primary benefits of price action trading is that it does not rely on lagging indicators. This makes it particularly useful for fast-moving markets, allowing traders to react quickly to price changes.

Choosing the Best Forex Day Trading Strategy for You

When it comes to Forex day trading, selecting the right strategy for your unique trading style, goals, and risk tolerance is crucial. The best Forex day trading strategy will align with your personality ability to manage risks. Below are some important factors to consider when choosing the best strategy for you:

Understand Your Risk Tolerance

Your risk tolerance plays a vital role in determining which Forex day trading strategy is best for you. If you are risk-averse and prefer stability, you may want to opt for a strategy that involves fewer trades and uses conservative stop-loss orders. On the other hand, if you are comfortable with higher risks, more aggressive strategies like scalping or news trading may suit you better.

- Low Risk Tolerance: Consider trend-following or range trading strategies, as they typically involve fewer trades and less risk. These strategies allow traders to enter trades based on established patterns and market conditions.

- High Risk Tolerance: If you are more comfortable with volatility and can handle rapid changes in the market. Scalping or news trading could be appropriate strategies. These strategies involve executing many trades throughout the day and capitalizing on smaller, quicker price movements. But they require a keen understanding of market dynamics and strong decision-making skills.

Assess Your Time Availability

Another important factor in choosing the right Forex day trading strategy is how much time you can dedicate to trading each day. If you only have a few hours to spare, you may want to choose a strategy that focuses on short-term trends. Or more significant price moves, allowing you to manage positions quickly.

- Limited Time: If you are only available for a few hours each day, consider trend-following strategies that allow you to identify profitable moves during that period. These strategies involve longer timeframes, such as the 15-minute or 1-hour chart. Giving you the opportunity to trade within your available timeframe.

- More Time: If you can dedicate several hours a day, you may want to consider scalping or breakout trading. Both of which involve more frequent trades. Scalping focuses on small price movements, while breakout trading captures larger market shifts after periods of consolidation.

Consider Your Personality and Discipline

Your personality and discipline are also key to choosing the right strategy. If you are patient and methodical, range trading or trend-following could be a good fit. These strategies require a calm approach and the ability to wait for the right entry and exit points.

On the other hand, if you are quick on your feet and enjoy high-paced environments, strategies. Like scalping or news trading may align better with your personality. These strategies require quick decision-making and a strong focus on real-time market movements.

Tools and Resources for Forex Day Traders

Successful Forex day traders use a variety of tools and resources to improve their trading decisions, manage risks, and stay informed. These tools help traders analyze the market, track trades, and make quicker, more accurate decisions.

Trading Platforms

A reliable trading platform is the foundation of any successful Forex day trading strategy. The platform is where you will execute your trades, analyze charts, and monitor market conditions in real time.

- MetaTrader 4 (MT4): One of the most popular trading platforms, Meta Trader 4 (MT4) offers a wide range of tools for technical analysis, and real-time trade execution. It is known for its user-friendly interface and the ability to support Expert Advisors (EAs), which allow traders to automate their strategies.

- MetaTrader 5 (MT5): The upgraded version of MT4, MetaTrader 5 offers additional features like more timeframes, more advanced charting tools. And an expanded economic calendar, making it suitable for both beginners and advanced traders.

- cTrader: Another popular platform, cTrader is known for its fast order execution, advanced charting tools, and customizable interface, making it ideal for active traders who want to focus on scalping or trend following.

Charting and Technical Analysis Tools

Technical analysis is essential for Forex day trading as it helps traders identify trends, price patterns, and entry/exit points. Several charting tools and indicators are available to assist traders in making data-driven decisions.

- TradingView: TradingView is a powerful and intuitive charting platform that allows traders to analyze price action, study trends, and share ideas with other traders. It offers a wide range of indicators and drawing tools, making it ideal for both beginner and advanced traders.

- RSI (Relative Strength Index): The RSI is a popular momentum oscillator that measures the strength of a trend and identifies potential overbought or oversold conditions. It is widely used in trend-following and range-trading strategies to spot reversal points.

- MACD (Moving Average Convergence Divergence): MACD is an indicator used to determine the direction of a trend and potential reversals. It is commonly used in breakout and trend-following strategies.

Economic Calendar

An economic calendar is an essential tool for news trading, as it helps traders track key economic events that can impact currency prices. These events include central bank meetings, economic reports, and geopolitical developments.

- Forex Factory: One of the most popular platforms for tracking economic events, Forex Factory offers a real-time calendar with detailed information on news releases, including their impact level and forecasted data.

- Investing.com Economic Calendar: Investing.com provides a detailed economic calendar that includes global events, economic indicators, and earnings reports. This tool is perfect for news traders who need to stay updated on market-moving events.

Risk Management Tools

Effective risk management is a critical component of any Forex day trading strategy. The following tools help traders manage their positions, control their exposure, and minimize potential losses.

- Stop-Loss and Take-Profit Orders: Stop-loss orders are essential for limiting losses, while take-profit orders help lock in profits when a trade reaches your desired target. These orders can be set automatically, reducing the emotional aspect of trading.

- Position Sizing Calculators: Position sizing calculators help traders determine the appropriate amount of capital to risk on each trade. By using a risk-to-reward ratio and your total trading capital, these tools ensure that your position size aligns with your risk tolerance.

Common Mistakes to Avoid in Forex Day Trading

While Forex day trading can be highly rewarding, it also comes with risks. Many traders, especially beginners, fall into common traps that can lead to losses or missed opportunities. Avoiding these mistakes can significantly improve your chances of success in the Forex market. Here are some of the most common errors traders make and how to avoid them:

Overtrading

One of the most common mistakes in Forex day trading is overtrading, or executing too many trades in a short period. This typically happens when traders try to force trades, believing they must always be in the market to make a profit. Overtrading can lead to unnecessary losses, especially when traders enter trades without a solid strategy.

- How to Avoid Overtrading: Stick to your trading plan and only enter trades that align with your Forex day trading strategy. It’s essential to have patience and avoid the temptation to trade simply for the sake of it.

Ignoring Risk Management

Risk management is crucial in Forex day trading, and ignoring it can lead to significant losses. Failing to set proper stop-loss orders, overleveraging, or risking too much capital on a single trade can quickly deplete your trading account.

- How to Avoid This Mistake: Always use stop-loss orders to protect your capital. Consider your risk tolerance and set a risk-to-reward ratio for every trade. A good rule of thumb is to risk no more than 1-2% of your trading capital on a single trade.

Letting Emotions Drive Decisions

Another common mistake in Forex day trading is letting emotions influence trading decisions. Fear, greed, and frustration can lead traders to make impulsive decisions, such as holding on to losing trades for too long or entering trades based on gut feelings rather than analysis.

- How to Avoid Emotional Trading: Develop and stick to a clear trading plan that includes entry and exit points, stop-loss levels, and position sizing. Having a structured approach helps reduce emotional interference and keeps you focused on your long-term goals.

Lack of a Trading Plan

A trading plan is essential for guiding your actions and decisions in the market. Many beginners enter the Forex market without a clear strategy, leading to erratic and unpredictable results. Trading without a plan often results in inconsistency and confusion.

- How to Avoid This Mistake: Develop a Forex day trading strategy that suits your trading style, risk tolerance, and available time. A well-thought-out trading plan should outline when to enter and exit trades, how much capital to risk, and how to manage positions.

Overleveraging

Leverage can amplify both profits and losses, and while it is a powerful tool, it can also lead to significant risks if not used carefully. Many traders, especially beginners, overuse leverage, which can quickly lead to large losses.

- How to Avoid Overleveraging: Use leverage cautiously and make sure your position size aligns with your capital and risk tolerance. Forex day traders should avoid the temptation of using high leverage to chase quick profits.

Failing to Stay Informed

In Forex day trading, staying informed about global economic events, central bank decisions, and market-moving news is crucial. Failing to keep track of these factors can result in unexpected price moves and missed opportunities.

- How to Avoid This Mistake: Keep up with relevant news and economic reports using tools like an economic calendar. Staying updated on the latest market developments helps you anticipate potential market movements and adjust your strategy accordingly.

Conclusion

Forex day trading offers numerous opportunities to profit from short-term market movements, but it also requires skill, discipline, and careful decision-making. By understanding the key elements of successful trading, choosing the right strategy, and avoiding common mistakes. Like overtrading and ignoring risk management, you can improve your chances of success.

Always remember that Forex day trading is a long-term endeavor that requires practice, patience, and continuous learning. With the right approach and tools, you can develop a solid foundation for profitable trading.

Whether you are just starting or already experienced in Forex day trading, implementing the right strategies, avoiding emotional trading, and learning from your mistakes will help you become a more successful trader. The key is consistency, discipline, and ongoing education in the dynamic world of Forex trading.

Read more Earn Passive Income with Forex Trading

Frequently Asked Questions

What is Forex day trading?

Forex day trading involves buying and selling currency pairs within the same trading day. The goal is to capitalize on short-term price movements in the foreign exchange market. Traders aim to profit from price fluctuations that happen during the day, rather than holding positions overnight.

What are the best Forex day trading strategies?

The best Forex day trading strategies depend on your risk tolerance, time commitment, and trading style. Common strategies include:

- Scalping: Involves making quick, small trades throughout the day.

- Trend Following: Traders identify and follow the overall direction of the market.

- Range Trading: Trading within a set price range, buying at support and selling at resistance.

- Breakout Trading: Taking positions when the price breaks out of a consolidation phase.

How much capital do I need to start Forex day trading?

The capital needed to start Forex day trading varies depending on your broker and trading style. However, many brokers allow you to start with as little as $100. It’s important to start with money you can afford to lose, especially as Forex day trading involves significant risk.

Can Forex day trading be profitable?

Yes, Forex day trading can be profitable, but it requires skill, discipline, and the ability to manage risks effectively. Success depends on factors such as the chosen strategy, market conditions, risk management, and continuous learning. It’s important to start with a well-researched plan and practice on demo accounts before trading with real money.