Trading Forex During Non-Farm Payroll News

When trading Forex, Non-Farm Payroll (NFP) is one of the most crucial events that can impact market volatility. Every month, traders closely watch the NFP report as it provides vital insights into the health of the U.S. economy. And can trigger significant price movements in the Forex market. If you are a Forex trader looking to capitalize on these movements, understanding how NFP news impacts the market. And knowing the best strategies to use can help you make more informed decisions. In Trading Forex During Non-Farm Payroll News, we will cover the fundamentals of NFP, its timing, and how to effectively trade during these high-impact news releases.

What is Non-Farm Payroll (NFP)?

Definition of Non-Farm Payroll (NFP)

Non-Farm Payroll (NFP) is a monthly economic report released by the U.S. Bureau of Labor Statistics. This report measures the total number of paid workers in the U.S. economy. Excluding farm workers, government employees, private household employees, and employees of nonprofit organizations. NFP data provides a snapshot of the employment status of the U.S. workforce, highlighting the growth or decline in job creation.

For Forex traders, NFP is a critical indicator because it signals the strength or weakness of the U.S. economy. A higher-than-expected NFP number typically suggests a robust economy, potentially leading to a stronger U.S. dollar. Conversely, a lower-than-expected result may signal economic challenges, causing the USD to weaken against other currencies.

How NFP Affects the Forex Market

NFP data has a significant impact on the Forex market, particularly on currency pairs involving the U.S. dollar (USD). Since the NFP report directly affects expectations for future interest rates. And monetary policy set by the Federal Reserve, it can lead to rapid price movements.

When the actual NFP number differs from the forecasted NFP figure. It often leads to sharp market reactions. For example, a stronger-than-expected NFP result could indicate potential inflationary pressures. Prompting the Federal Reserve to raise interest rates sooner than anticipated, which in turn may drive the USD higher. On the other hand, weaker-than-expected results can lead to speculation that the Federal Reserve may hold off on tightening monetary policy, which could weaken the USD.

Therefore, understanding how NFP data is likely to impact the Forex market helps traders make decisions about which currency pairs to trade and whether to adopt a long or short position.

Understanding the NFP Release Timing

When is NFP Released?

The Non-Farm Payroll (NFP) report is typically released on the first Friday of each month. The Bureau of Labor Statistics publishes the report at 8:30 AM Eastern Time (ET). This timing is crucial for traders to understand, as it can set the stage for market volatility in the hours following the announcement.

For traders, knowing the exact release time of NFP allows them to prepare by observing market conditions leading up to the release. If you’re trading on the day of the report, it’s important to be aware that significant price fluctuations can happen as soon as the data is released.

NFP Release Impact on Market Volatility

The release of NFP typically leads to high market volatility, especially within the first few minutes to an hour after the data is published. Forex traders expect the U.S. dollar (USD) to show strong reactions to the NFP announcement, and price swings can be dramatic. During this time, liquidity can also vary, making it important for traders to manage risk appropriately.

Currency pairs involving the USD, such as EUR/USD, USD/JPY, and GBP/USD, experience the most volatility during NFP releases. Even cross-currency pairs that do not involve the USD can see movements if the U.S. dollar is a major component in global trade.

Because of this volatility, some traders choose to avoid trading NFP news altogether. While others may use it to capitalize on the fast-moving price action. If you are comfortable with risk and have the ability to manage trades under pressure. NFP trading can offer profitable opportunities, but it is essential to be cautious as the market can move unpredictably.

Key Factors to Watch During NFP Announcements

Forecast vs Actual Numbers

When trading Non-Farm Payroll (NFP) news, one of the most critical factors to monitor is the difference between the forecasted NFP figure and the actual NFP result. Before the report is released, economists and analysts predict the number of jobs that will be added to the U.S. economy in the previous month. This forecast is widely available to traders and is used as a benchmark to gauge market expectations.

If the actual NFP number exceeds the forecast, it generally indicates a stronger-than-expected economy. Which can lead to bullish pressure on the U.S. dollar (USD). On the other hand, if the actual number falls short of expectations, the USD can weaken, signaling potential economic slowdowns or concerns about inflation and employment growth.

The market reaction is most intense when there is a significant deviation between the forecast and actual figures. Often triggering sharp price movements across major USD currency pairs, such as EUR/USD, GBP/USD, and USD/JPY.

Unemployment Rate

The unemployment rate is another key indicator closely tied to the NFP report. The unemployment rate measures the percentage of the workforce that is unemployed but actively seeking employment. It is widely followed because it reflects the health of the job market. And can influence future monetary policy decisions by the Federal Reserve.

If the unemployment rate decreases alongside a strong NFP number, it suggests a tightening labor market. A stronger economy, which may prompt the Federal Reserve to consider interest rate hikes to curb inflation. Conversely, an increase in the unemployment rate, especially with a weaker NFP number. Could signal economic challenges and potentially prompt the Federal Reserve to delay interest rate increases or even cut rates. Which could weaken the USD.

For traders, monitoring changes in the unemployment rate during NFP announcements is essential. As it directly impacts expectations for future monetary policies and can lead to market shifts.

Average Hourly Earnings

Average Hourly Earnings (AHE) is another important factor during NFP announcements. A rise in hourly earnings generally signals wage inflation. Which can lead to increased consumer spending and potential inflationary pressures. Forex traders pay attention to AHE because rising wages can prompt the Federal Reserve to raise interest rates to manage inflation.

On the other hand, a weaker-than-expected rise in average hourly earnings can suggest lower inflationary pressures. And could affect the Fed’s decision to maintain current interest rates. A surge in hourly earnings could support a stronger U.S. dollar (USD), while weak earnings may lead to USD weakness. Monitoring this data alongside the NFP numbers can provide valuable insight into the economic health of the U.S. And help Forex traders make more informed decisions.

Risks and Challenges of Trading NFP

Increased Volatility and Price Gaps

One of the most significant risks when trading NFP announcements is the potential for increased volatility and price gaps. Since NFP reports can cause sharp market movements, especially when the actual numbers deviate from expectations. Currency prices can jump drastically within minutes after the release.

This volatility can result in price gaps, where the price moves from one level to another without trading at intermediate prices, often leaving traders with unfilled orders or positions that are far from their entry price. For example, a major USD currency pair, like EUR/USD, can suddenly shift from 1.1000 to 1.0950 in the span of seconds if the NFP report surprises the market.

To mitigate these risks, Forex traders should practice caution when trading during NFP releases. Using stop-loss orders and ensuring positions are appropriately sized are crucial to avoid significant losses during volatile market conditions. Slippage, or the difference between expected price and actual price, is also common during high-impact news like NFP, so managing expectations and risks is essential.

False Breakouts and Whipsaws

Another challenge in trading NFP is the occurrence of false breakouts and whipsaw price action. After the NFP data is released, it’s not uncommon for the market to initially react strongly, breaking through key levels of support or resistance. However, the market may quickly reverse direction, trapping traders in positions they did not anticipate.

These false breakouts can result in losses if traders don’t wait for confirmation before entering trades. Whipsaw action occurs when prices move sharply in one direction only to reverse quickly in the opposite direction, often causing confusion among traders who have already entered positions. For example, after an NFP release, prices may spike upwards before quickly turning around and dropping, leaving traders with unprofitable trades.

To avoid these situations, it is essential to wait for confirmation of market direction, using technical analysis and understanding that the market may not always follow the anticipated trend immediately after the news release.

Emotional and Psychological Factors

The emotional and psychological factors during NFP trading are another challenge. The volatility and quick price movements associated with the release can provoke emotions such as fear, greed, and panic. Traders may rush to open positions or close them prematurely due to the high-pressure environment, leading to poor decision-making and potential losses.

To overcome these emotional challenges, it’s crucial to follow a trading plan and stick to it. Risk management techniques such as pre-set stop-loss orders and position sizing can help maintain control over trades and avoid emotional decision-making. Additionally, demo trading before engaging in live trading during NFP events can help traders get comfortable with the fast-paced nature of the market.

Trading Strategies for NFP News

Range-Bound Strategy

One popular strategy during NFP news releases is the range-bound strategy. This strategy assumes that the NFP news will not lead to significant price movements in the immediate aftermath. Especially when the actual NFP number is close to the forecasted figure. The market may trade within a defined range as traders digest the news and await further data.

In this case, traders set buy orders near the support level and sell orders near resistance levels. The goal is to capture small profits from price fluctuations within the established range. Technical analysis tools like bollinger bands and support and resistance zones can help identify these key levels. Traders employing this strategy should be prepared for possible breakouts. But they focus on profits gained from short-term oscillations within the range.

The key to successfully executing a range-bound strategy during NFP is patience. Traders should wait for confirmation that the price is indeed stuck within a range before entering positions. A sudden shift in momentum could disrupt the strategy, leading to potential losses.

Breakout Strategy

Another widely-used strategy for trading NFP is the breakout strategy, which capitalizes on significant price movements that can follow an NFP release. When the actual NFP figure deviates significantly from the forecast. There can be sharp price movements as traders adjust their positions.

In a breakout strategy, traders identify key levels of support or resistance before the news release. If the market price breaches these levels following the NFP announcement. It signals a strong market trend. Traders would then enter positions in the direction of the breakout, aiming to profit from the momentum.

Stop-loss orders are crucial in this strategy to protect against the risk of a false breakout. Where the price moves past a key level before reversing. Therefore, having a well-defined risk management plan is essential for any breakout strategy during NFP news.

Fade the News Strategy

The fade the news strategy involves going against the initial price movement following the NFP release. Traders following this strategy believe that initial market reactions may be exaggerated. Or overly emotional and often reverse after a short period.

For example, after an NFP release, if the market makes an initial sharp move upwards based on positive numbers. Traders who are fading the news might sell into the rally, anticipating a correction. Conversely, if the market initially falls due to a disappointing report, traders would look to buy in expectation of a recovery.

Risk management plays a crucial role here, as fading news requires the trader to accept the possibility of larger initial drawdowns before the market corrects itself. Patience is key, as price reversals can take time to materialize.

Common Mistakes to Avoid When Trading NFP

Overleveraging Positions

One of the most common mistakes made when trading NFP news is overleveraging positions. Given the potential for sharp price movements following the NFP release, traders may feel compelled to increase their leverage in order to maximize potential profits. However, this increases the risk of substantial losses in case the market moves against the position.

The volatility around the NFP release makes it difficult to predict price action with high certainty, and overleveraging can result in margin calls or forced position closures. To avoid this mistake, traders should use moderate leverage and ensure their positions are properly sized in relation to their risk tolerance.

Ignoring Risk Management

Risk management is crucial when trading any news event, but it is particularly important during NFP releases, where price movements can be extreme and fast. Many traders make the mistake of ignoring their stop-loss orders or failing to set proper risk parameters during the high volatility of an NFP release.

To protect against significant losses, traders should always have a stop-loss order in place, even if they plan to ride out short-term fluctuations. It’s also helpful to avoid risking more than a small percentage of the trading capital on a single NFP trade—generally no more than 1-2% of the total account balance.

Reacting Too Quickly to Initial Moves

Another common mistake is reacting too quickly to the initial price movement after the NFP release. The market tends to exhibit extreme volatility immediately after the report, and prices often move rapidly in one direction before reversing or consolidating.

Traders who enter positions too quickly based on initial price movements might get caught in a whipsaw, where the market reverses just as they enter a trade. This can lead to losses if the trader is unable to react fast enough or if they don’t allow for the possibility of a price correction. Patience and waiting for the market to settle after the first few minutes can help traders avoid this mistake.

Failing to Follow a Trading Plan

Trading NFP without a clear trading plan is another significant mistake. The rapid price fluctuations can lead to impulsive decision-making, which is often detrimental to long-term profitability. Traders should avoid making decisions based on emotion or short-term market movements.

Before the NFP release, traders should have a defined strategy in place. This includes determining key entry and exit points, setting stop-loss and take-profit levels, and deciding how much of their capital to risk on the trade. By following a pre-determined trading plan, traders can stay focused and avoid rash decisions during the high volatility surrounding the NFP report.

Best Currency Pairs to Trade During NFP

EUR/USD (Euro/US Dollar)

The EUR/USD pair is widely regarded as one of the most liquid and traded currency pairs in the world. During an NFP release, the EUR/USD typically exhibits significant volatility due to high market interest in the U.S. economy. Which is heavily influenced by Non-Farm Payroll data. The movement in this currency pair can be sharp and fast, providing opportunities for scalpers and day traders to capture short-term price fluctuations.

Traders should closely monitor the NFP report’s impact on the U.S. dollar and adjust their strategies accordingly. With tight spreads and ample market liquidity. EUR/USD is often considered a go-to pair for trading during NFP announcements.

USD/JPY (U.S. Dollar/Japanese Yen)

The USD/JPY currency pair is another top choice for trading during the NFP report. Known for its high liquidity and strong price movement, USD/JPY tends to react quite dramatically to U.S. economic news, particularly employment figures like those from the NFP release. The Japanese Yen is often viewed as a safe haven during periods of global uncertainty. And its movements against the U.S. dollar can provide significant trading opportunities.

Because of the volatility often witnessed in the USD/JPY pair following the NFP report, traders must be prepared for potential price swings. This currency pair is suitable for both intraday and swing traders who can handle its volatility.

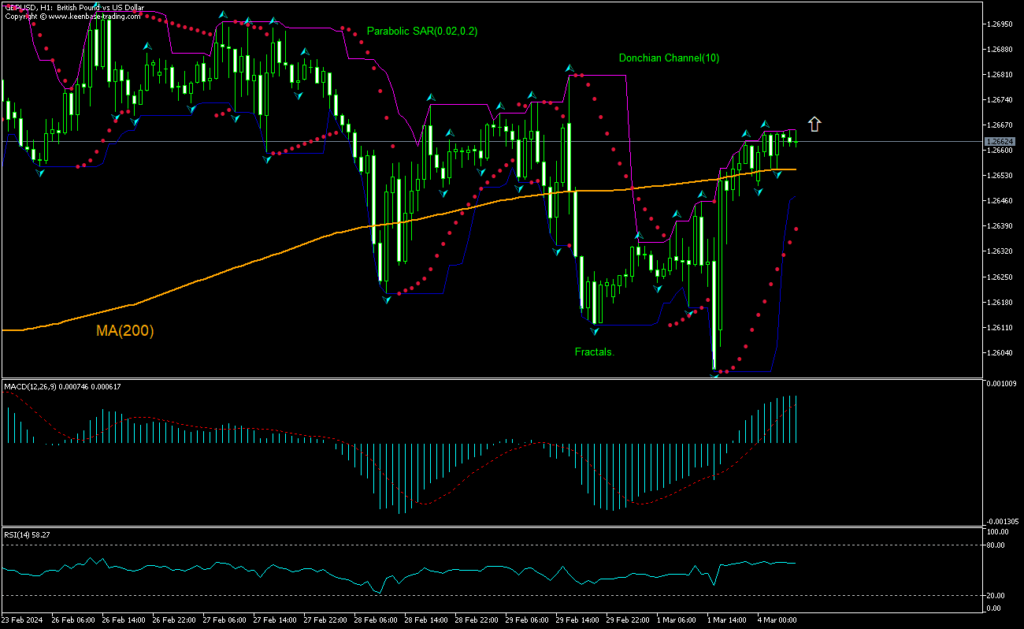

GBP/USD (British Pound/U.S. Dollar)

The GBP/USD is another popular currency pair among forex traders during NFP releases. The U.S. dollar’s impact on the pound makes it particularly sensitive to NFP news. Traders focusing on the GBP/USD during this period can experience large price swings, as the British pound often reacts strongly to shifts in U.S. economic sentiment.

However, trading GBP/USD can also be risky, as it is more susceptible to larger fluctuations compared to other pairs, especially after a surprising NFP report. Traders should consider employing risk management techniques, such as stop-loss orders, when trading this volatile currency pair during the NFP announcement.

AUD/USD (Australian Dollar/U.S. Dollar)

The AUD/USD pair is influenced by the commodity market and global risk sentiment, making it another viable option for trading during NFP news. While the Australian dollar often moves in correlation with global economic data, the U.S. Non-Farm Payroll report has a strong influence on this pair due to its impact on the U.S. economy and risk sentiment.

Traders should note that AUD/USD can experience sharp price fluctuations during NFP announcements, particularly if the data surprises traders. It is essential to stay updated on any other economic events or commodity market trends that could affect the Australian dollar.

USD/CAD (U.S. Dollar/Canadian Dollar)

The USD/CAD pair, also known as the Loonie, is another highly liquid currency pair that traders favor during NFP releases. The Canadian dollar is heavily influenced by movements in crude oil prices, but the U.S. employment data tends to have a strong correlation with the Canadian currency.

Traders should look for major price shifts in the USD/CAD following the NFP announcement, as it could move significantly depending on the state of the U.S. economy. As with all pairs, applying sound risk management techniques is essential when trading during such high-volatility events.

Is Trading NFP Suitable for Every Trader?

Not for Beginners

Trading NFP can be a thrilling experience, but it is not suitable for every trader, especially for beginners. The extreme volatility surrounding NFP news means that price movements can be unpredictable and fast. This makes it difficult for novice traders to react effectively, increasing the risk of substantial losses.

Beginners should gain experience with less volatile trading environments and familiarize themselves with technical analysis, economic indicators, and risk management strategies before attempting to trade during the NFP announcement. Without a clear understanding of market behavior during these events, it’s easy to make impulsive decisions and lose money.

Suitable for Experienced Traders

Experienced traders who have mastered technical analysis and market psychology will find NFP trading highly rewarding. These traders have the knowledge and skills to capitalize on sharp market movements that occur after the NFP report is released. They also understand the importance of using risk management techniques such as stop-loss orders, take-profit levels, and proper position sizing to safeguard against the inherent risks.

Traders with experience in trading high-volatility news events can handle the intense market swings that occur during the NFP release and can leverage advanced strategies like breakout trading and range-bound trading.

Risk Tolerance is Key

Even for seasoned traders, NFP trading requires a high level of risk tolerance. The potential for both profit and loss is amplified by the volatility and the unpredictability of the report’s actual figures. Traders must evaluate whether their risk tolerance aligns with the rapid price movements typical of NFP announcements.

For traders who prefer consistent and steady profits, the risks associated with NFP news trading may not align with their trading style. However, those who thrive on high-risk, high-reward situations may find NFP trading a compelling challenge.

Professional Traders Use NFP as Part of a Larger Strategy

Professional forex traders typically do not base their entire strategy on just the NFP news release. Instead, they view it as a piece of the larger economic puzzle and incorporate it into their broader trading strategy. They consider multiple economic indicators, technical analysis, and sentiment analysis to form a well-rounded approach to NFP trading.

For these professionals, NFP news serves as an additional piece of data to confirm or invalidate a pre-existing market bias. They also understand the importance of managing risk and staying patient, waiting for clear confirmation before entering any positions.

Conclusion

Trading during Non-Farm Payroll (NFP) news releases can be both exciting and challenging. The NFP report is one of the most influential economic indicators in the forex market. Providing insights into the U.S. labor market and influencing market sentiment across the globe. Whether you’re a seasoned trader or just starting out, understanding how to navigate the volatility surrounding NFP news is crucial for successful forex trading.

From currency pair selection to implementing effective trading strategies, there are various factors to consider when trading NFP news. Experienced traders can capitalize on the sharp market movements that typically follow the report’s release, while beginners must approach NFP trading with caution and a solid understanding of market dynamics. Always remember to use risk management techniques, such as stop-loss orders, to protect your capital during these volatile events.

While NFP trading may not be suitable for every trader, it can offer lucrative opportunities for those with the right skills, experience, and risk tolerance. By staying informed about economic developments, preparing for possible market fluctuations, and practicing disciplined trading strategies, you can increase your chances of success when trading NFP news.

Read more Using Moving Averages in Forex Trading

Frequently Asked Questions

What is the best time to trade NFP news?

The best time to trade NFP news is right after the report is released, which is typically at 8:30 AM EST on the first Friday of each month. This is when the market tends to experience the highest volatility and price movement.

Which currency pairs are most affected by NFP news?

The most affected currency pairs by NFP news include EUR/USD, USD/JPY, GBP/USD, AUD/USD, and USD/CAD. These pairs tend to exhibit the most volatility and liquidity during the NFP announcement.

Is it safe to trade during NFP?

Trading during NFP can be risky due to the volatility and unpredictable nature of market reactions. However, with the right risk management strategies and a solid trading plan, it can also be profitable. It’s essential to ensure you have enough experience and a high-risk tolerance before trading during these high-impact events.

How do I prepare for NFP news trading?

To prepare for NFP news trading, you should:

- Stay updated on economic indicators leading up to the release.

- Identify the best currency pairs to trade based on your strategy.

- Use technical analysis to assess potential support and resistance levels.

- Implement stop-loss and take-profit orders to manage risk.

Can I trade NFP as a beginner?

While NFP trading can be profitable, it may not be the best choice for beginner traders due to the market volatility and the rapid price changes that occur around the announcement. It is recommended for beginners to practice with demo accounts and gain experience with less volatile market conditions before trading NFP news.