How to Build a Forex Trading Plan

Creating a Forex trading plan is a vital step toward achieving long-term success in the world of currency trading. Whether you are a beginner or an experienced trader, having a well-structured trading plan helps you make informed decisions, manage risks, and stay disciplined. By following a step-by-step guide, How to Build a Forex Trading Plan tailored to your trading goals and strategies, ensuring consistent performance over time.

Introduction to How to Build a Forex Trading Plan

In the volatile world of Forex trading, relying on instincts or impulsive decisions often leads to losses. A Forex trading plan acts as your personalized roadmap, guiding you through market movements with precision and confidence.

Building a trading plan begins with setting realistic goals, defining strategies, and outlining a clear risk management framework. It is not just about writing a plan but sticking to it consistently and updating it as you learn and grow.

For example, imagine starting a road trip without a map or GPS. You may wander aimlessly, wasting time and resources. Similarly, trading without a solid plan leaves you vulnerable to emotional decision-making and poor outcomes. A comprehensive trading plan ensures you have a strategy for every scenario, improving your chances of success in the Forex market.

By understanding the importance of a trading plan and how to create one, you can transform your trading approach, achieving consistency and minimizing unnecessary risks.

What is a Forex Trading Plan?

A Forex trading plan is a structured document or guideline that outlines a trader’s goals, strategies, and processes for entering and exiting trades. It serves as a blueprint that helps traders make objective decisions, even in highly volatile market conditions.

Key Features of a Forex Trading Plan

- Clear Objectives: A trading plan includes specific, measurable, and time-bound trading goals, such as achieving a 10% return in a month or improving win rates.

- Defined Strategies: It specifies which trading strategies will be used, whether day trading, swing trading, or position trading.

- Risk Management Rules: Every trading plan incorporates rules for limiting losses and protecting profits, such as setting stop-loss orders or defining the risk-reward ratio.

- Trading Schedule: A detailed plan also includes the timeframes you will focus on, such as daily or hourly charts.

Why Do You Need a Forex Trading Plan?

The Forex market is dynamic and unpredictable, making it easy to lose focus or trade emotionally. A trading plan helps:

- Minimize emotional trading by enforcing discipline.

- Maintain consistency by following pre-defined rules.

- Improve risk management and protect your capital.

Example of a Forex Trading Plan

For instance, a simple trading plan for a beginner may include:

- Risking only 1% of account equity per trade.

- Trading major currency pairs like EUR/USD.

- Using technical analysis indicators such as moving averages or RSI.

By crafting and adhering to a well-defined trading plan, you create a systematic approach to Forex trading that prioritizes discipline, minimizes risks, and enhances profitability.

Why is a Forex Trading Plan Important?

A Forex trading plan is the foundation of successful trading, providing structure and discipline in the often unpredictable Forex market. It is essential for traders of all experience levels, as it helps mitigate risks and improve decision-making.

Benefits of a Forex Trading Plan

- Reducing Emotional Trading

- One of the biggest challenges in trading is controlling emotions. Fear and greed can lead to impulsive decisions. A well-defined trading plan eliminates guesswork, allowing you to stick to logical and objective decisions.

- Ensuring Consistency

- Trading without a plan often results in inconsistent actions and outcomes. A trading plan promotes consistency by providing a clear roadmap for entering and exiting trades, leading to better performance over time.

- Improving Risk Management

- A key part of any trading plan is a risk management strategy, which helps protect your capital. By setting stop-loss levels, risk-reward ratios, and position sizes, you can minimize potential losses and safeguard profits.

- Tracking and Evaluating Performance

- A trading plan makes it easier to track and analyze your trading performance. By reviewing past trades, you can identify patterns, refine strategies, and make data-driven improvements.

Why Beginners Need a Trading Plan

For beginners, a trading plan is especially important as it prevents costly mistakes caused by inexperience. It helps new traders stay focused, avoid unnecessary risks, and build confidence over time.

Key Components of a Forex Trading Plan

A successful Forex trading plan is built on several essential components that address every aspect of trading, from goal setting to performance evaluation. Let’s explore each component in detail:

Trading Goals

Your goals act as a benchmark for success.

- Short-term goals: For instance, improving your win rate by 5% in the next month.

- Long-term goals: Achieving a consistent return of 15-20% annually.

Make sure your goals are realistic and measurable.

Risk Management Strategy

A solid risk management plan protects your trading capital and minimizes losses.

- Risk per trade: Limit risk to 1-2% of your account balance.

- Stop-loss levels: Predefine exit points to control losses.

- Risk-reward ratio: Aim for a ratio of at least 1:2 to ensure potential profits outweigh risks.

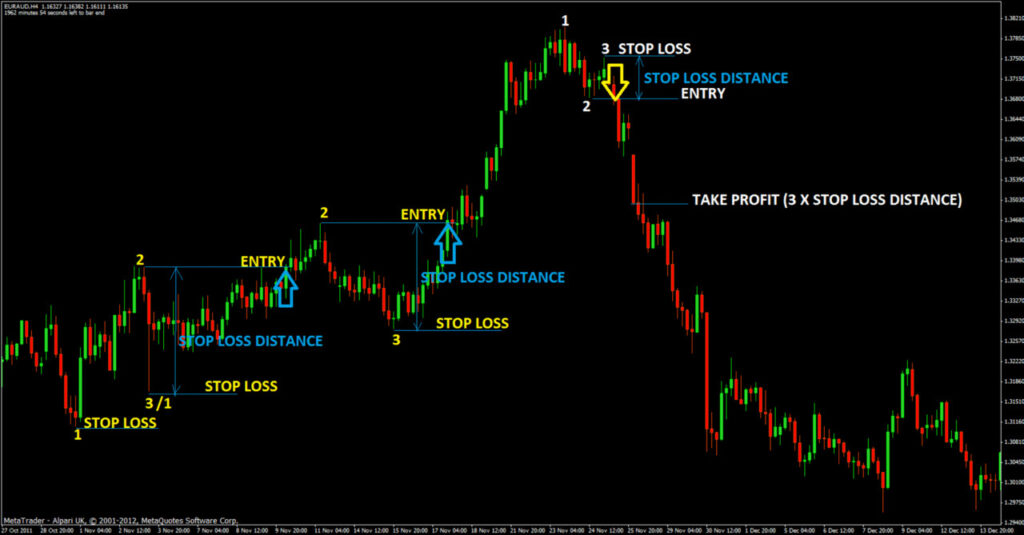

Entry and Exit Criteria

Define when and how you will enter or exit a trade.

- Entry signals: Use specific tools or patterns, such as support/resistance levels, moving averages, or candlestick patterns.

- Exit strategy: Plan your profit targets and conditions for closing trades.

Position Sizing

Determine how much of your capital to allocate per trade. Position sizing depends on your risk tolerance, account size, and trading strategy.

Trading Timeframe

Choose a timeframe that aligns with your trading style:

- Day traders may focus on 15-minute or hourly charts.

- Swing traders often analyze daily or weekly charts.

Performance Evaluation

Regularly review your trading history to assess what works and what doesn’t.

- Use a trading journal to record details of each trade, including entry/exit points, position size, and outcomes.

- Analyze the data to refine your strategy and improve over time.

Example of a Comprehensive Forex Trading Plan

A complete plan might include:

- Risking 1% of the account per trade.

- Trading only during the London and New York sessions.

- Using a combination of technical and fundamental analysis.

- Reviewing trades weekly to track progress.

By including these key components, your Forex trading plan becomes a powerful tool for achieving success and maintaining consistency in the highly competitive Forex market.

Step-by-Step Guide-How to Build a Forex Trading Plan

Creating a Forex trading plan requires careful consideration and a structured approach. Below is a detailed, step-by-step guide to help you build a trading plan that aligns with your goals and trading style.

Set Clear Trading Goals

Start by defining your short-term and long-term trading goals.

- Example of short-term goals: Achieve a 5% profit in a month or reduce trading losses by 10%.

- Example of long-term goals: Double your account size in two years while maintaining risk management practices.

Ensure your goals are SMART: Specific, Measurable, Achievable, Relevant, and Time-bound.

Assess Your Risk Tolerance

Understanding how much risk you can afford to take is crucial.

- Determine your risk per trade, typically 1-2% of your total account balance.

- Use tools like position size calculators to maintain consistency.

By defining your risk tolerance, you ensure that losses do not jeopardize your trading capital.

Choose Your Trading Style

Select a trading style that suits your personality, time commitment, and market knowledge. Common styles include:

- Day trading: Entering and exiting trades within a day.

- Swing trading: Holding positions for several days to capture medium-term market moves.

- Scalping: Executing multiple small trades to profit from minor price changes.

Define Your Entry and Exit Criteria

Develop a clear set of rules for when to enter and exit trades.

- Use technical analysis tools like support and resistance levels, moving averages, and trendlines.

- Set profit targets and stop-loss levels for each trade to control your outcomes.

Develop a Risk Management Strategy

- Implement a risk-reward ratio (e.g., 1:2 or 1:3) to ensure potential profits outweigh losses.

- Diversify your trades to avoid overexposure to a single currency pair.

Create a Trading Schedule

Identify the best times to trade based on your chosen currency pairs and trading strategy.

- Example: Focus on the London and New York sessions for higher volatility.

Maintain a Trading Journal

Track every trade by recording:

- Entry and exit points.

- Trade duration and position size.

- Outcomes and emotional state during the trade.

Regularly review your journal to identify strengths and weaknesses in your strategy.

Common Mistakes to Avoid When Building a Forex Trading Plan

While building a Forex trading plan, traders often make avoidable mistakes that hinder their success. Below are the most common errors and how to avoid them.

Lack of Clear Goals

Failing to define specific goals leads to aimless trading. Ensure your goals are SMART to provide a clear direction.

Ignoring Risk Management

Many traders overlook the importance of risk management, leading to significant losses. Always set stop-loss orders and define a risk-reward ratio for each trade.

Overcomplicating the Plan

A complex trading plan can be overwhelming and difficult to follow. Keep your plan simple and actionable, focusing on key components like risk tolerance, entry criteria, and performance evaluation.

Failing to Adapt the Plan

The Forex market is dynamic, and failing to adapt your plan to changing market conditions can lead to poor results. Regularly review and update your trading plan to stay relevant.

Neglecting Emotional Discipline

Even the best trading plan cannot compensate for emotional trading. Stick to your plan and avoid making impulsive decisions based on fear or greed.

Tips to Avoid These Mistakes

- Use a checklist to ensure you follow your plan.

- Seek feedback from experienced traders to refine your approach.

- Practice your plan on a demo account before trading live.

By avoiding these common mistakes, you can build a robust trading plan that enhances your decision-making and improves your trading outcomes.

Tips for Sticking to Your Forex Trading Plan

Having a Forex trading plan is only part of the journey; staying committed to it is equally important. Discipline and consistency play a key role in ensuring your plan translates into trading success. Below are actionable tips to help you stick to your trading plan.

Start with a Realistic Plan

- A plan that is too ambitious or complex can be difficult to follow.

- Ensure your plan is realistic, simple, and aligns with your trading skills and market experience.

Use a Checklist Before Each Trade

- Create a checklist that includes your entry criteria, risk-reward ratio, and position sizing.

- Review the checklist before executing any trade to ensure all conditions are met.

Practice Emotional Discipline

- Avoid trading based on emotions such as fear or greed.

- Stick to your predefined rules, even during volatile market conditions.

Set Reminders for Risk Management

- Use alerts or reminders to reinforce important rules, such as not risking more than 1-2% of your account per trade.

- These safeguards ensure you maintain capital preservation.

Regularly Review Your Performance

- Analyze your trading journal weekly or monthly.

- Look for patterns in your successes and failures to adjust and refine your plan.

Avoid Overtrading

- Stick to your planned trading schedule and avoid entering trades impulsively.

- Remember that quality trades matter more than quantity.

Leverage Accountability

- Share your trading plan with a mentor, peer, or trading group.

- Accountability helps you stay disciplined and prevents deviations from your plan.

By following these tips, you can ensure that your Forex trading plan becomes a reliable framework for consistent and disciplined trading.

Tools and Resources for Building a Forex Trading Plan

Modern technology and educational resources have made it easier than ever to create and follow a comprehensive Forex trading plan. Here are some of the best tools and resources to support your trading journey.

Trading Platforms

Choose a reliable Forex trading platform that offers tools for planning and executing trades:

- MetaTrader 4 (MT4) or MetaTrader 5 (MT5): Widely used platforms with advanced charting tools, technical indicators, and customizable features.

- cTrader: Offers an intuitive interface and automated trading capabilities.

Forex Charting Tools

Accurate charting tools help you analyze price movements and identify trading opportunities.

- TradingView: Provides real-time charts, technical analysis tools, and the ability to save chart setups.

- Forex Tester: Allows you to backtest your trading strategies on historical data.

Economic Calendars

An economic calendar is essential for staying updated on key events that impact the Forex market.

- Forex Factory: Tracks major economic announcements and provides details on their potential market impact.

- Investing.com: Offers a detailed calendar with customizable filters for events relevant to your trades.

Risk Management Tools

- Position Size Calculators: Tools like Myfxbook or BabyPips calculators help you determine the correct lot size based on your account size and risk tolerance.

- Stop-Loss and Take-Profit Calculators: Ensure you set appropriate levels for exits.

Educational Resources

- Forex Blogs and Forums: Sites like BabyPips and Forex Peace Army offer guides, tips, and discussions on building a Forex trading plan.

- Trading Courses: Enroll in courses from reputable sources to enhance your knowledge of trading strategies and risk management.

Trading Journals

Keeping a detailed record of your trades is vital for evaluating performance.

- Edgewonk: A paid trading journal tool with advanced analytics.

- Excel Sheets: A cost-effective option for manually recording and analyzing your trades.

Demo Accounts

Practice on demo accounts before going live. These accounts simulate the Forex market and allow you to refine your trading plan without risking real money.

Example Workflow Using Tools

- Analyze the market using TradingView charts.

- Plan your trade based on signals and validate them against your checklist.

- Use a position size calculator to manage risk.

- Execute the trade on MetaTrader or your preferred platform.

- Record the trade details in a trading journal for performance evaluation.

By leveraging these tools and resources, you can build an effective and data-driven Forex trading plan that enhances your decision-making and profitability.

Conclusion

Building a well-structured Forex trading plan is the cornerstone of becoming a successful and disciplined trader. It acts as a roadmap, guiding you through market complexities and helping you make informed decisions rather than impulsive ones. By including key components such as your trading goals, risk management strategies, and trading schedule, you can create a comprehensive plan tailored to your needs.

The real challenge, however, lies in adhering to the plan. With discipline, emotional control, and regular reviews, you can stay committed to your strategy and avoid common pitfalls. Additionally, leveraging modern tools like trading platforms, economic calendars, and risk management calculators will enhance your efficiency and accuracy.

Remember, the Forex market is dynamic, so be open to refining your plan as you gain experience and market insights. A robust trading plan, combined with continuous learning, will set you on the path to consistent profitability and long-term success in Forex trading.

Read more Understanding Forex Candlestick Patterns

Frequently Asked Questions

What is a Forex trading plan?

A Forex trading plan is a structured set of guidelines that outlines how a trader will approach the market. It includes your trading goals, risk management strategies, entry and exit criteria, and the tools you’ll use to analyze and execute trades.

Why is having a Forex trading plan important?

A trading plan is crucial because it helps traders avoid emotional decision-making, minimizes risk, and ensures consistency in trading. It also provides a clear framework for evaluating performance and making improvements over time.

How do I create a Forex trading plan?

To create a Forex trading plan:

- Define your trading goals and objectives.

- Establish your risk tolerance and position sizing rules.

- Select a trading strategy that aligns with your goals.

- Set criteria for trade entries and exits.

- Regularly review and refine your plan.

What tools can I use to build a Forex trading plan?

Some useful tools include:

- Trading platforms like MetaTrader 4 or TradingView.

- Economic calendars such as Forex Factory.

- Risk management tools like position size calculators.

- Trading journals like Edgewonk or Excel spreadsheets.