Top Forex Strategies for Small Accounts

Forex trading offers a wealth of opportunities, but for traders with small accounts, finding the right strategies is essential for success. Trading with limited capital requires smart risk management. And well-structured strategies to maximize profits while minimizing losses. In this article, we’ll explore Top Forex Strategies for Small Accounts, that can help traders succeed in the highly volatile foreign exchange market. We will discuss key strategies, risk management tips, and trading platforms. That work best for traders with smaller capital.

Understanding Forex Trading with a Small Account

What is Forex Trading?

Forex trading, also known as foreign exchange trading, involves buying and selling currencies in the global market. The aim is to profit from fluctuations in currency prices. Currencies are traded in pairs, such as the EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen). Traders speculate on whether the price of one currency will rise or fall relative to the other currency in the pair. The forex market operates 24 hours a day, five days a week, making it a dynamic and flexible market for traders.

For small account holders, understanding the basic terms and mechanics of forex trading is crucial. Here’s a brief overview of key terms:

- Currency Pairs: These are two currencies that are traded against each other. For example, EUR/USD means you are buying euros and selling U.S. dollars.

- Pips: A pip is the smallest unit of price movement in the forex market. It’s important for small account traders to understand how to calculate pips for profit or loss.

- Leverage: Leverage allows traders to control a larger position with a smaller amount of capital. However, leverage can increase both profits and losses, so it’s important to use it cautiously, especially with a small account.

The Importance of Risk Management in Small Accounts

When trading with a small account, risk management becomes even more critical. Without a solid risk management strategy, traders risk wiping out their accounts in a short period. Here are a few key aspects of risk management:

- Risk-to-Reward Ratio: This ratio helps traders assess potential profits versus potential losses. A common risk-to-reward ratio is 1:2, meaning for every $1 of risk, the trader aims to make $2 in profit.

- Position Sizing: For small accounts, it’s important to calculate the correct position size based on your risk tolerance. Traders with small accounts should risk only a small percentage (e.g., 1-2%) of their capital on each trade.

- Stop-Loss Orders: Stop-loss orders are a vital tool for limiting losses. A stop-loss order automatically closes a trade when the price reaches a predetermined level, helping traders avoid significant losses.

- Capital Preservation: The primary goal of trading with a small account is to preserve capital. Avoiding overtrading and ensuring that each trade aligns with your overall strategy can prevent substantial losses.

By incorporating effective risk management practices, traders can safeguard their small accounts while still making calculated, profitable trades.

Top Forex Trading Strategies for Small Accounts

Scalping

Scalping is a popular forex trading strategy for traders with small accounts due to its low-risk and high-frequency nature. It involves making numerous small trades throughout the day to capture tiny price movements, typically in the range of a few pips. While scalping may seem like a strategy suited for larger accounts, it can be highly effective for small accounts as well. The key here is to focus on short-term price fluctuations and use high leverage to maximize small moves without risking too much capital.

Benefits of Scalping for Small Accounts:

- Quick profits: Scalping allows traders to make several small profits throughout the day.

- Low capital requirement: Small accounts can take advantage of tight spreads and leverage to increase trade size without risking too much capital.

Risks of Scalping:

- Transaction costs: High-frequency trading can incur higher spreads and commissions, which can eat into profits.

- Time commitment: Scalping requires constant monitoring of the markets, making it a time-intensive strategy.

Day Trading

Day trading involves entering and exiting trades within the same trading day, often multiple times. Unlike scalping, day traders hold positions for longer periods, ranging from minutes to hours, but still close all positions before the market closes. This strategy is suitable for small accounts because it allows traders to capitalize on both short-term price movements and market trends without holding positions overnight, thereby avoiding overnight fees or swap rates.

Benefits of Day Trading for Small Accounts:

- Reduced overnight risk: Since positions are closed by the end of the trading day, traders avoid the risks associated with overnight positions.

- More opportunities: Day traders can use technical analysis and news events to identify short-term trading opportunities.

Risks of Day Trading:

- Stressful and fast-paced: Day trading requires quick decision-making and can be stressful, especially for beginners.

- Higher risk of overtrading: The excitement of day trading can lead to impulsive trades, resulting in greater risk.

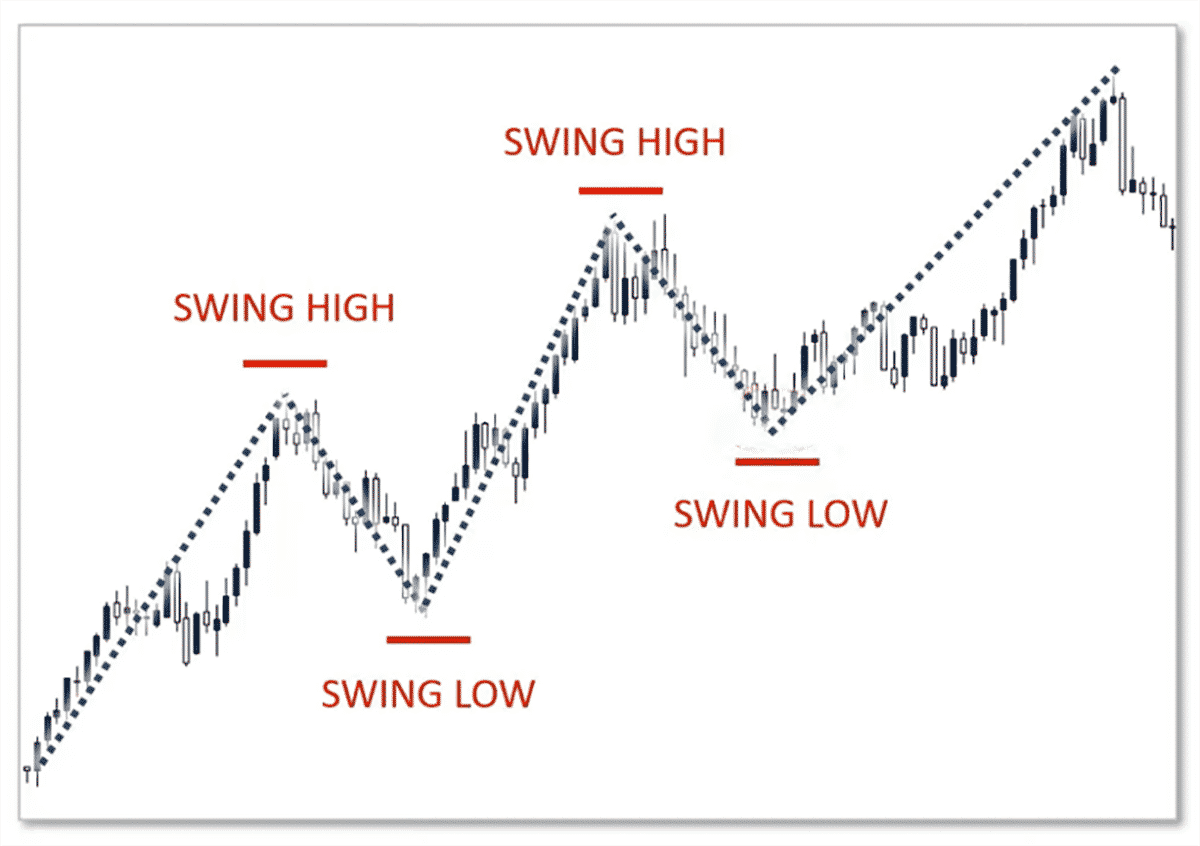

Swing Trading

Swing trading is a longer-term strategy that aims to capture price swings or movements within a trend over a few days to weeks. Unlike scalping or day trading, swing traders do not focus on the small fluctuations of the market but instead look for medium-term price moves. This strategy suits small accounts as it doesn’t require constant monitoring, and trades can be executed with larger stop-loss orders, allowing traders to stay in a trade longer.

Benefits of Swing Trading for Small Accounts:

- Less time-consuming: Swing traders don’t need to monitor the markets all day.

- Potential for higher rewards: Since swing trades last longer, they have the potential for larger profits than shorter-term strategies.

Risks of Swing Trading:

- Exposure to overnight risk: Swing trading requires holding positions overnight, which exposes traders to potential market reversals.

- Requires patience: Swing trading can be slower in terms of profit realization, which may require more patience.

Carry Trading

Carry trading involves borrowing a currency with a low-interest rate and using it to buy a currency with a higher interest rate. The goal is to profit from the interest rate differential between the two currencies. While carry trading requires larger accounts to handle the margin, small account traders can still use this strategy with caution and proper position sizing.

Benefits of Carry Trading for Small Accounts:

- Consistent returns: With the right pair of currencies, traders can earn regular interest income.

- Less frequent trades: Carry trades are often long-term positions that require less frequent monitoring.

Risks of Carry Trading:

- Currency fluctuations: Significant moves in currency prices can wipe out the interest profits, making carry trading riskier during high-volatility periods.

- Interest rate changes: Central bank policy changes can affect the interest rate differential, thus impacting profits.

Risk Management Tips for Small Forex Accounts

Setting Stop-Loss and Take-Profit Levels

In forex trading, stop-loss and take-profit orders are essential tools for risk management, especially for small accounts. A stop-loss order automatically closes a trade when the price reaches a certain level, limiting potential losses. On the other hand, a take-profit order closes a trade when the price reaches a predetermined profit level.

For traders with small accounts, setting appropriate stop-loss and take-profit levels can make the difference between success and failure. Here are a few tips:

- Use a 1-2% Risk Rule: Never risk more than 1-2% of your account balance on a single trade. This helps protect your account from significant drawdowns.

- Avoid Tight Stop-Losses: Setting stop-loss orders too close to the entry point can result in frequent stop-outs, especially in volatile markets. A larger stop-loss gives your trade more room to breathe.

- Set Realistic Profit Targets: Be realistic about your profit targets. Aim for a 1:2 risk-to-reward ratio to ensure your potential profits outweigh your risks.

By setting stop-loss and take-profit levels effectively, traders can manage their risk while still allowing for profitable trades.

Calculating Position Size for Small Accounts

Position sizing is a critical component of risk management for small accounts. Properly calculating your position size ensures you don’t risk too much on a single trade. The size of your position should be determined by your account balance, the risk tolerance, and the stop-loss distance.

Position Sizing Formula:

- Risk per trade = Account balance x Risk percentage

- Position size = Risk per trade / (Stop-loss in pips x Pip value)

For example, if your account balance is $1,000 and you are willing to risk 2% per trade ($20), and your stop-loss is 50 pips, then:

Position Size = $20 / (50 pips x $0.10 per pip) = 4,000 units

By calculating your position size properly, you can manage your risk effectively, especially when trading with a small account.

Diversification and Hedging

Although small accounts have limited capital, diversification can still play an important role in reducing overall risk. Diversifying by trading multiple currency pairs or using different strategies can help protect your portfolio from significant losses.

Hedging is another risk management tool, where traders take opposite positions in correlated currency pairs to offset potential losses. For example, if you’re long on EUR/USD, you might hedge by taking a short position in USD/JPY. While hedging can help reduce risk, it can also limit potential profits, so it should be used cautiously.

By incorporating diversification and hedging into your strategy, you can reduce the potential impact of a losing trade on your small account.

Conclusion

In this article, we’ve explored several Forex trading strategies for small accounts, such as scalping, day trading, swing trading, and carry trading. Additionally, we’ve discussed essential risk management tips, including setting stop-loss and take-profit levels, calculating position size, and the importance of diversification and hedging.

By using these strategies and focusing on effective risk management, traders with small accounts can increase their chances of success in the forex market.

Choosing the Right Trading Platform for Small Accounts

Importance of Platform Selection for Small Accounts

Choosing the right trading platform is crucial, especially for traders with small accounts. A user-friendly platform can simplify the trading process, allowing traders to focus on strategies and market analysis rather than struggling with technical difficulties. When selecting a platform, small account traders should prioritize factors like low fees, reliable execution speed, and advanced charting tools.

Some of the key features to look for in a platform for small accounts include:

- Low Minimum Deposit: Many platforms allow traders to open accounts with a small deposit, which is ideal for traders with limited capital.

- Low Spreads and Commissions: A platform with low spreads and commissions can significantly impact a small account’s profitability. Small account traders should look for brokers that offer tight spreads and competitive pricing.

- Leverage Options: For small accounts, leverage can amplify trading positions. However, traders should use leverage cautiously to avoid large losses.

- Demo Accounts: A demo account is a great way for traders to practice without risking real money. Small account traders should opt for platforms that offer free demo accounts to test strategies in a simulated environment.

- Mobile Access: Trading on the go can be crucial for small account traders. A platform with a mobile app that allows you to monitor trades and adjust positions is beneficial.

Popular trading platforms for small accounts include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, all of which offer low-cost trading with robust features suitable for beginner and experienced traders alike.

Key Considerations When Choosing a Forex Trading Platform

- Regulation: It’s important to choose a platform that is regulated by a reputable financial authority. A regulated broker ensures safety and transparency for small account traders. Regulatory bodies such as the Financial Conduct Authority (FCA), U.S. Commodity Futures Trading Commission (CFTC), or the Australian Securities and Investments Commission (ASIC) provide oversight, ensuring fair trading practices.

- Ease of Use: Small account traders may not have time to learn complex platforms. Look for a user-friendly interface that allows easy navigation and quick execution of trades.

- Customer Support: 24/7 customer support is essential, especially for traders in different time zones. Good support ensures that issues are resolved quickly, helping traders stay focused on the market.

- Risk Management Tools: The platform should provide risk management tools such as stop-loss orders, take-profit orders, and trailing stops. These tools help traders protect their small accounts from significant losses while allowing them to take advantage of profitable trades.

By focusing on these essential factors, small account traders can choose a trading platform that suits their needs and maximizes their chances of success in the Forex market.

Psychological Factors in Forex Trading with Small Accounts

The Emotional Challenges of Trading with Small Accounts

One of the biggest challenges for small account traders is managing emotions while trading. With limited capital, the pressure to make profits quickly can lead to emotional decision-making, which often results in poor trading outcomes. Common psychological factors that can impact small account traders include:

- Fear of Loss: When trading with a small account, the fear of losing money can lead to hesitation or premature exit from trades. This fear can also prevent traders from setting proper stop-loss orders or risking too much capital on each trade.

- Greed for Quick Profits: The desire to make fast profits can drive traders to take excessive risks. Small account traders might increase their position sizes or enter multiple trades without considering the potential downside.

- Overconfidence: After a few successful trades, traders may become overconfident and take larger risks, leading to losses. It’s important for small account traders to stay grounded and maintain discipline.

Managing Emotions in Forex Trading with Small Accounts

- Develop a Trading Plan: A well-structured trading plan helps traders stay focused and avoid emotional decision-making. The plan should include entry and exit strategies, risk management guidelines, and clear profit goals. Traders with small accounts should follow their trading plan to prevent impulse decisions.

- Use Proper Risk Management: Having clear risk management strategies, such as limiting the percentage of the account balance risked on each trade, can help reduce emotional stress. For instance, risking no more than 2% of the account balance on each trade is a good rule to follow for small accounts.

- Maintain Realistic Expectations: Small account traders often expect to make large profits quickly, which can lead to disappointment and frustration. It’s important to set realistic profit goals and understand that trading is a long-term game that requires patience and consistency.

- Take Breaks: If emotions are running high, it’s best to take a break. Step away from the screen, clear your mind, and return to trading with a fresh perspective. Overtrading due to frustration or fear can lead to poor decisions, so taking regular breaks is crucial for emotional balance.

- Focus on the Process, Not the Outcome: Successful trading is about following your strategy and risk management plan. Focusing too much on the outcome (profit or loss) can lead to poor emotional decisions. Instead, small account traders should focus on executing their strategy consistently and learning from each trade.

By understanding and managing these psychological factors, traders with small accounts can improve their chances of success and avoid the common pitfalls that lead to emotional trading.

Conclusion

In this article, we’ve explored key aspects of choosing the right trading platform and managing the psychological factors in Forex trading with small accounts. From selecting a platform with the right features to managing emotions and setting realistic expectations, these factors play a vital role in achieving long-term success. By combining solid strategies with proper risk management and emotional control, small account traders can enhance their trading performance and navigate the forex market with confidence.

Common Mistakes to Avoid in Forex Trading with Small Accounts

Overleveraging

One of the most common mistakes small account traders make is overleveraging. Leverage allows traders to control larger positions with a smaller amount of capital, but it can also magnify losses. With small accounts, traders often get tempted to use high leverage to increase potential profits quickly. However, this can lead to significant losses, as the margin for error becomes very slim.

Tip: Use leverage conservatively, and avoid leveraging more than what your account can safely handle. A good rule of thumb is to risk no more than 2-5% of your total account balance per trade.

Ignoring Risk Management

Failing to implement effective risk management is another critical mistake. Many small account traders are eager to make quick profits, and in the pursuit of larger returns, they often neglect proper stop-loss placement or the size of their trades. Without a solid risk management plan, losses can quickly accumulate and wipe out an entire account balance.

Tip: Set stop-loss orders for every trade and always define your risk-to-reward ratio. This helps protect against large losses while allowing room for profits.

Trading Without a Plan

Trading without a well-defined strategy or plan is one of the most significant mistakes, especially for small account traders. Without a plan, traders may enter and exit trades based on emotions, gut feelings, or market noise. This lack of discipline often results in losses and missed opportunities.

Tip: Always develop a comprehensive trading plan that includes clear entry and exit points, risk management rules, and specific goals. Stick to the plan and avoid trading impulsively.

Focusing Too Much on Short-Term Gains

Many small account traders fall into the trap of trying to make quick profits in the short term. They take on high-risk trades or overtrade in an attempt to grow their account rapidly. While scalping and day trading can be profitable, they require extensive experience and the right mindset.

Tip: Focus on long-term profitability rather than trying to get rich quickly. A slow and steady approach with consistent risk management will provide more sustainable results in the long run.

Neglecting to Practice on a Demo Account

Another mistake is skipping the demo account phase. Many small account traders jump straight into live trading without first practicing on a demo account. This lack of preparation can lead to costly mistakes as new traders are unfamiliar with the platform or market behavior.

Tip: Before trading with real money, use a demo account to practice strategies, get comfortable with the trading platform, and refine your skills.

Letting Emotions Take Control

Emotions like fear, greed, and hope can cloud judgment and lead to irrational trading decisions. For small account traders, the psychological pressures of trading with limited capital can exacerbate these emotions. Fear of losing money can lead to missed opportunities, while greed can prompt traders to take unnecessary risks.

Tip: Stay disciplined and stick to your trading plan. If you find yourself becoming overly emotional, take a break from the markets and regain your composure before re-engaging.

conclusion

In conclusion, Forex trading with a small account requires a careful balance of discipline, patience, and strategic planning. By focusing on responsible leverage use, adhering to solid risk management practices, and maintaining a clear, consistent trading plan, small account traders can minimize their risks and maximize their chances of long-term success. It is essential to avoid emotional trading, practice with demo accounts, and remain focused on steady, incremental growth rather than seeking quick profits. Forex trading is a journey that takes time, and with the right approach, traders with small accounts can achieve sustainable profitability and develop the skills necessary to thrive in the market.

Read more Central Bank Policies and Forex Markets

Frequently Asked Questions

Can I make money with a small Forex account?

Yes, it is possible to make money with a small Forex account. However, it requires discipline, patience, and effective risk management. By focusing on low-risk strategies, using leverage wisely, and avoiding emotional trading, small account traders can grow their accounts over time.

How much money do I need to start Forex trading with a small account?

You can start Forex trading with a small account by depositing as little as $50 to $100, depending on the broker’s minimum deposit requirements. However, it is essential to remember that the smaller the account, the more cautious you need to be with risk management to protect your capital.

What is the best strategy for small Forex accounts?

Some of the best strategies for small Forex accounts include scalping, day trading, and swing trading, all of which can be effective when combined with strong risk management. A long-term approach that focuses on steady profits rather than quick, high-risk gains is often more successful.

How do I manage risk with a small Forex account?

Risk management is critical for small account traders. You should:

- Use stop-loss orders to limit potential losses.

- Risk no more than 2-5% of your total account balance per trade.

- Diversify your trades and avoid placing all your capital into one position.

- Set realistic risk-to-reward ratios (e.g., 1:2 or 1:3).

Should I use leverage with a small Forex account?

Using leverage can amplify both profits and losses. For small accounts, it’s important to use leverage cautiously. High leverage increases the risk of substantial losses, so it’s advisable to start with lower levels of leverage and gradually adjust as you gain experience.