Best Forex Pairs for Beginners

Starting your forex trading journey can be both exciting and overwhelming. As a beginner, selecting the right currency pairs is crucial to building a solid foundation. Some pairs are easier to trade due to their liquidity, volatility, and historical performance, making them ideal for new traders. In this guide, we’ll explore the best forex pairs for beginners, offering insights to help you make informed decisions and start trading with confidence.

Introduction to the Best Forex Pairs for Beginner Traders

If you’re new to Forex trading, choosing the right currency pairs can make all the difference between a profitable journey and an uphill battle. Forex trading is all about buying one currency while selling another. But the world of currency pairs can seem overwhelming for beginners. This article is designed to simplify the process and guide you toward the best Forex pairs for beginner traders.

As a new trader, it’s important to focus on liquid and stable currency pairs that offer good trading opportunities without excessive volatility. Whether you’re aiming for steady growth or just starting to get a feel for the market, this guide will help you make informed decisions. By the end, you’ll know exactly which Forex pairs to consider for a solid start in your trading career.

Understanding Forex Pairs

Before diving into the best Forex pairs for beginners. It’s essential to understand the concept of Forex pairs. In the Forex market, currencies are always traded in pairs. This means when you buy one currency, you’re simultaneously selling another. Understanding how these pairs work and their structure is key to making informed decisions in your trading journey.

What Are Forex Pairs?

In the simplest terms, Forex pairs are the currencies traded against each other in the global market. Every Forex pair consists of two components:

- Base Currency: The first currency in the pair (for example, in EUR/USD, the Euro is the base currency).

- Quote Currency: The second currency in the pair (for example, in EUR/USD, the US Dollar is the quote currency).

The value of a Forex pair represents how much of the quote currency is needed to buy one unit of the base currency. For instance, if the EUR/USD pair is priced at 1.10, it means you need 1.10 US dollars to buy 1 Euro.

The Role of Base and Quote Currency

When trading Forex pairs, the base currency is the one you’re buying or selling. It’s the first currency listed in the pair and holds the most significance. The quote currency, on the other hand, is used to determine the value of the base currency. For example, if the GBP/USD pair is priced at 1.25, it means that 1 British Pound is equal to 1.25 US Dollars.

This structure helps you understand how to manage your trades effectively. When you buy a Forex pair, you are buying the base currency and selling an equivalent amount of the quote currency. Conversely, when you sell the pair, you are selling the base currency and buying the quote currency.

The Best Forex Pairs for Beginner Traders

For beginners, selecting the right Forex pairs is crucial to achieving consistent success in the market. Some currency pairs are more suitable for novice traders due to their liquidity, stability, and lower volatility. As a beginner, focusing on these pairs will help you learn the fundamentals of trading without being overwhelmed by sudden price swings. Below are some of the best Forex pairs for beginner traders:

Major Currency Pairs

Major currency pairs are the most popular and actively traded pairs in the Forex market. They include the most stable and liquid currencies, which makes them ideal for beginner traders. These pairs usually have lower spreads, which means lower costs of trading. Here are the top major pairs you should focus on:

- EUR/USD (Euro/US Dollar): The EUR/USD is the most traded Forex pair in the world, making it highly liquid and stable. It offers tight spreads and low volatility, which makes it easier for beginners to manage. The Euro and US Dollar are both major world currencies with strong economies backing them, making this pair a safe bet for a solid start.

- GBP/USD (British Pound/US Dollar): Known for its high volatility, the GBP/USD can provide exciting opportunities for profit. However, it’s also prone to sudden price changes, so beginners should trade it with caution. Despite the volatility, its liquidity makes it an excellent choice for those looking to experience market movement.

- USD/JPY (US Dollar/Japanese Yen): The USD/JPY is another popular pair known for its stability and liquidity. It’s less volatile than the GBP/USD, making it a good choice for beginners. Additionally, Japan’s safe-haven status makes the JPY a reliable currency for trading during uncertain market conditions.

- USD/CHF (US Dollar/Swiss Franc): The USD/CHF is known for its safe-haven status due to Switzerland’s strong economy. It offers steady liquidity and is a great option for beginners who want a pair that isn’t too volatile. The Swiss Franc tends to remain relatively stable, making it suitable for those looking for low-risk trades.

Minor Currency Pairs

Minor currency pairs are still very liquid but often involve currencies from smaller economies. They tend to be a little more volatile than major pairs, but they can offer great opportunities for beginners once they gain some experience. Here are some popular minor pairs:

- EUR/GBP (Euro/British Pound): The EUR/GBP pair is an excellent choice for beginners due to its relatively stable movements. It’s a highly liquid pair, and the Euro and British Pound economies are both strong and stable.

- GBP/JPY (British Pound/Japanese Yen): Although more volatile, the GBP/JPY can be an exciting choice for beginners. It offers the opportunity for larger price movements and higher potential profits, but beginners should be cautious of its rapid price fluctuations.

Key Factors to Consider When Choosing Forex Pairs

Selecting the best Forex pair is not just about picking popular or widely traded pairs; there are several key factors to consider when making your choice. Understanding these factors will help you identify which pairs are most suitable for your trading style and experience level. Here are the essential factors to keep in mind:

Volatility and Liquidity

When choosing a Forex pair, volatility and liquidity are two of the most important factors to consider. Volatility refers to how much the price of a currency pair fluctuates, while liquidity refers to how easily a currency pair can be bought or sold without causing significant price changes.

- Volatility: High volatility can offer great profit opportunities, but it can also result in larger losses, especially for beginners. It’s important to balance risk with potential reward. For beginners, pairs with moderate volatility, like EUR/USD, are often a safer choice.

- Liquidity: Liquid currency pairs, such as the EUR/USD and GBP/USD, are easier to trade because they have more participants in the market. They typically have tighter spreads and less slippage, making them ideal for beginners.

Spreads and Costs

The spread is the difference between the bid price (what you sell for) and the ask price (what you buy for). The smaller the spread, the less you have to pay in transaction costs, which is essential for beginner traders who are still learning the ropes. Major pairs, such as EUR/USD, tend to have the smallest spreads, making them cheaper to trade.

- Lower Spreads: Beginner traders should focus on currency pairs with narrow spreads to reduce the transaction costs. Currency pairs like USD/JPY and USD/CHF often offer tighter spreads.

- Higher Spreads: Some less liquid or exotic pairs may have larger spreads, making them more expensive to trade. Beginners should avoid these pairs until they become more experienced.

Trading Hours and Market Activity

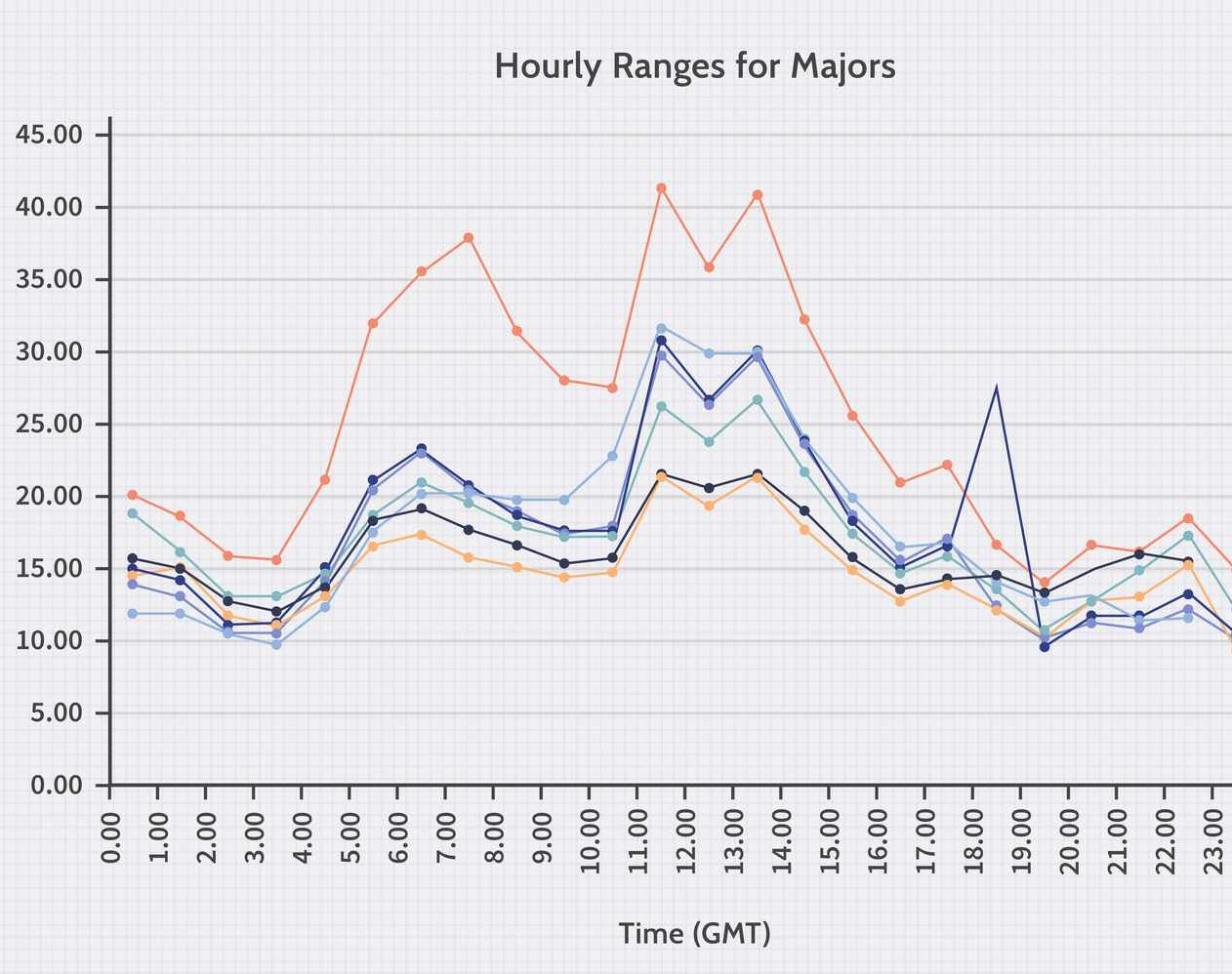

Another crucial factor in selecting Forex pairs is understanding the trading hours of the markets and how they affect the activity of the pairs you’re interested in. Forex trading operates 24 hours a day, but not all hours are equally active.

- Best Trading Times: The most liquid and active Forex markets are during the London/New York overlap (from 12:00 PM to 4:00 PM GMT). During these hours, currency pairs like EUR/USD and GBP/USD see the most price movement.

- Low-Activity Times: Trading during off-peak hours, such as when the Asian markets are open, might lead to lower market activity and wider spreads, which can be challenging for beginners. Therefore, timing is important when selecting the right Forex pairs.

Tips for Beginner Traders in Forex

Starting out in Forex trading can feel overwhelming, but with the right strategies and mindset, it’s possible to navigate the market and increase your chances of success. Below are some valuable tips for beginner traders in Forex that will help you develop a solid foundation and avoid common pitfalls.

Start with a Demo Account

Before risking real money, practice trading on a demo account. Most Forex brokers offer demo accounts that allow you to trade with virtual money, simulating real market conditions. This is the best way to learn how to place trades, manage positions, and test out different strategies without the risk of losing actual funds.

- Benefits of a Demo Account: You can familiarize yourself with the trading platform, understand order types, and get used to the dynamics of the market without any pressure.

- Transition to Real Trading: Once you’re comfortable with the demo account, start trading with small amounts of real money. Gradually increase your position size as you gain more confidence.

Educate Yourself Continuously

Forex trading is a lifelong learning process. The market is constantly evolving, and it’s crucial to keep yourself updated on new strategies, market trends, and economic events. Take advantage of educational resources such as:

- Books: There are numerous books on Forex trading that can teach you about market analysis, risk management, and trading psychology.

- Online Courses and Webinars: Many brokers and professional traders offer free or paid courses that can help you sharpen your skills.

- Forums and Communities: Join Forex communities to exchange ideas, ask questions, and learn from more experienced traders.

Focus on Risk Management

Risk management is the cornerstone of successful trading. As a beginner, it’s important to never risk more than 1-2% of your total trading capital on a single trade. This ensures that even if you face a losing streak, you can stay in the game long enough to recover and profit.

- Stop Loss Orders: Use stop-loss orders to automatically close a trade if the market moves against you. This can help limit your losses and protect your capital.

- Position Sizing: Always calculate the proper position size based on your risk tolerance. This ensures you don’t risk too much of your account balance on a single trade.

Stick to a Trading Plan

A trading plan is essential for maintaining discipline and consistency in your trading. Your plan should include:

- Trading Strategy: Outline the technical or fundamental analysis tools you will use to make decisions.

- Risk-Reward Ratio: Define your risk-to-reward ratio, typically aiming for at least a 1:2 ratio (for every dollar you risk, you aim to make two dollars).

- Trading Goals: Set clear, realistic goals, such as targeting a specific monthly return or limiting your loss percentage.

Be Patient and Avoid Overtrading

Many beginner traders fall into the trap of overtrading—making too many trades in a short period, often driven by emotion or impatience. It’s important to remain patient and wait for high-quality setups based on your strategy.

- Quality Over Quantity: Focus on making well-thought-out trades rather than trying to capitalize on every market movement.

- Emotional Control: Avoid letting emotions like fear, greed, or frustration dictate your trading decisions. Emotional discipline is key to long-term success in Forex.

Conclusion

Starting your Forex trading journey as a beginner can be both exciting and challenging. By focusing on the best Forex pairs for beginners, managing your risk effectively, and committing to continuous learning, you can set yourself up for success in the long run. Remember that patience, education, and a well-crafted trading plan are your best allies in the Forex market.

As you gain experience and refine your trading skills, you’ll start to develop your own unique strategies. In the beginning, it’s essential to focus on building a solid foundation rather than chasing quick profits. By choosing the right Forex pairs, practicing consistently, and following the tips for beginner traders, you’ll be on your way to mastering the Forex market.

Read more Currency Correlations in Forex Trading

Frequently Asked Questions

What are the best Forex pairs for beginners?

For beginner traders, the best Forex pairs to start with are those that are highly liquid, stable, and less volatile. These include major currency pairs such as:

- EUR/USD (Euro/US Dollar)

- GBP/USD (British Pound/US Dollar)

- USD/JPY (US Dollar/Japanese Yen)

- USD/CHF (US Dollar/Swiss Franc)

These pairs are less prone to sudden fluctuations and have smaller spreads, making them ideal for beginners.

Why is risk management important in Forex trading?

Risk management is crucial in Forex trading to protect your capital and avoid significant losses. By implementing strategies such as stop-loss orders, calculating position sizes, and maintaining a risk-to-reward ratio, you can limit potential losses and stay in the market long enough to profit over time.

How do I start trading Forex as a beginner?

To get started with Forex trading, follow these steps:

- Open a demo account with a Forex broker to practice trading without risking real money.

- Learn the basics of Forex trading, including understanding currency pairs, market analysis, and trading platforms.

- Develop a trading plan that includes a strategy, risk management rules, and clear trading goals.

- Start small with real money, using a conservative approach to risk management.

- Keep learning and improving your trading skills.

What is a trading plan, and why do I need one?

A trading plan is a structured approach that outlines your trading strategy, risk management rules, and trading goals. It helps you stay disciplined, avoid emotional trading, and ensure consistency in your decisions. Having a solid plan will guide you in making informed decisions and improve your chances of success in Forex trading.

How much money do I need to start trading Forex?

The amount of money you need to start trading Forex depends on your broker’s minimum deposit requirement and your risk tolerance. Many brokers allow you to start with as little as $100. However, it’s advisable to start with an amount you are comfortable losing while you gain experience.