Earn Passive Income with Forex Trading

Forex trading has long been considered an exciting way to earn money, with its potential for high returns. But did you know that it can also be a source of passive income? Many traders now leverage Forex strategies to generate income without constant involvement. In Earn Passive Income with Forex Trading, we will explore how you can get started with Forex trading for passive income, the essential strategies involved, and the risks and rewards of trading in the Forex market. If you’re looking to earn passive income through Forex. This guide will provide you with the knowledge to make informed decisions.

Introduction to Forex Trading for Passive Income

What is Forex Trading?

Forex trading involves buying and selling currencies on the foreign exchange market, aiming to profit from fluctuations in exchange rates. The Forex market is the largest and most liquid financial market in the world, with a daily trading volume exceeding $6 trillion. It operates 24/5, giving traders the flexibility to trade at almost any time of day.

Now, let’s discuss Forex trading for passive income. Passive income refers to money earned with minimal active effort. While traditional Forex trading involves active market participation, certain strategies can be automated or managed with minimal input, turning Forex trading into a passive income stream. This allows traders to benefit from the market without needing to be glued to their computers all day.

Why Forex Trading Can Be a Source of Passive Income?

With the right tools, such as automated trading systems, copy trading, or swing trading, Forex can become an effective way to earn passive income. Once set up, these systems require minimal effort on your part while continuing to work around the clock. This enables traders to benefit from currency fluctuations and market trends without being involved in day-to-day decisions.

Understanding Forex Trading

What is Forex Trading?

Forex trading is the act of buying one currency while simultaneously selling another. It’s done in currency pairs, such as EUR/USD (Euro/US Dollar), where the first currency is the base currency, and the second is the quote currency. Traders attempt to profit by predicting whether the base currency will rise or fall in value relative to the quote currency.

Forex trading occurs in a decentralized market, meaning there’s no physical location like a stock exchange. Instead, it operates through over-the-counter (OTC) trading via computer networks. This means that Forex traders can engage in currency exchange from virtually anywhere in the world.

How Does Forex Trading Work?

To understand how Forex works, let’s break it down. When you engage in Forex trading, you are essentially betting on whether the price of a currency pair will rise or fall. You will buy the pair if you think the base currency will strengthen, or sell it if you believe the base currency will weaken.

Here’s how the process works in simple steps:

- Choose a currency pair: For example, EUR/USD.

- Open a position: Buy or sell the currency pair based on market analysis.

- Use leverage: Forex trading allows you to control larger positions with a smaller amount of capital, known as leverage.

- Close the position: You can exit the trade when your target price is reached or at the stop-loss level.

The ability to trade on leverage is one of the key reasons Forex trading appeals to traders seeking to generate income. However, leverage amplifies both potential profits and risks, which is why it’s important to apply effective risk management strategies.

The Concept of Passive Income in Forex Trading

What is Passive Income?

Passive income refers to earnings generated with little or no ongoing effort from the individual after the initial setup. Unlike active income, which requires constant work (such as a 9-to-5 job), passive income is earned through systems that run autonomously or with minimal intervention. In the context of Forex trading, passive income can be generated by employing strategies that allow you to profit from the Forex market. Without constantly monitoring trades or manually executing buy/sell orders.

The concept of passive income in Forex may sound contradictory at first because Forex trading is often associated with active market participation. However, with the right tools and strategies, you can set up a system that generates income with minimal input. The key to turning Forex trading into passive income lies in leveraging automation, expert advice, and well-researched trading plans. That reduce the need for constant supervision.

How Forex Trading Can Generate Passive Income?

There are several ways Forex traders can generate passive income:

- Automated Trading: By using Forex bots or algorithmic trading systems, traders can set up their strategies to execute trades on their behalf. These automated systems follow predefined rules and can work 24/7, even while the trader sleeps.

- Copy Trading: This involves copying the trades of successful traders. Platforms that offer social trading allow less experienced traders to invest in the same trades as expert traders. Thus earning passive income by leveraging the knowledge and expertise of others.

- Swing Trading and Position Trading: By holding trades for longer periods, traders can benefit from long-term market movements without the need for constant monitoring. These strategies allow for a passive approach while still capitalizing on market trends.

While Forex trading can offer passive income, it’s important to remember that all trading involves risk. And proper risk management is essential to maintaining consistent profitability over time.

Key Strategies for Earning Passive Income in Forex

Automated Forex Trading (Bots and Algorithms)

One of the most popular ways to earn passive income in Forex trading is through the use of automated trading systems. These systems, commonly known as Forex trading bots or algorithms. Are designed to execute trades on behalf of the trader based on predefined criteria. Automated systems can scan the market, identify opportunities, and place orders much faster than a human could.

The biggest advantage of using automated trading for passive income is that it removes the need for constant supervision. Once the system is set up, it can run independently, taking advantage of trading opportunities even when you’re not actively monitoring the market. Forex bots are often available through brokers or third-party platforms. And they come with varying levels of customization.

Copy Trading and Social Trading

Another effective way to earn passive income in Forex is through copy trading. Copy trading, also known as social trading or mirror trading, allows traders to copy the strategies of more successful traders. This method involves choosing a trader with a proven track record and copying their trades automatically in your own account.

With copy trading, you don’t need to have in-depth knowledge of the Forex market. You simply select an experienced trader whose strategy aligns with your risk tolerance and goals. As the expert trader opens and closes positions. Your account mirrors those same trades.

One of the key benefits of copy trading is the ability to leverage the expertise of others. Making it an excellent option for beginners. .

Swing Trading and Position Trading

Swing trading and position trading are strategies that allow traders to profit from long-term market trends while requiring minimal daily involvement. Unlike day trading, which involves opening and closing trades within a single trading day, swing traders hold positions for days, weeks, or even months, capturing larger price movements.

In swing trading, traders aim to profit from short- to medium-term price fluctuations. This strategy doesn’t require constant monitoring of the market but does require analyzing price patterns, market trends, and economic events.

Position trading, on the other hand, involves holding positions for even longer periods, typically from several weeks to months, based on long-term market trends. This method works well for traders looking for a more hands-off approach to Forex trading, as it requires less frequent decision-making and trade monitoring.

Risk Management in Forex Trading for Passive Income

Why Risk Management is Crucial in Forex Trading

When it comes to Forex trading for passive income, one of the most important factors for long-term success is risk management. The Forex market can be highly volatile, and while it offers opportunities for profit, it also carries significant risks. Without proper risk management strategies, you may find yourself exposed to larger losses, which can erase your profits.

Risk management refers to the techniques and strategies traders use to limit their potential losses while maximizing their profit opportunities. In Forex, it’s essential to set realistic stop-loss orders, use appropriate leverage, and diversify your trading strategies to manage risk effectively. It’s also important to know when to cut your losses and accept a loss as part of the trading process.

Common Risk Management Techniques in Forex

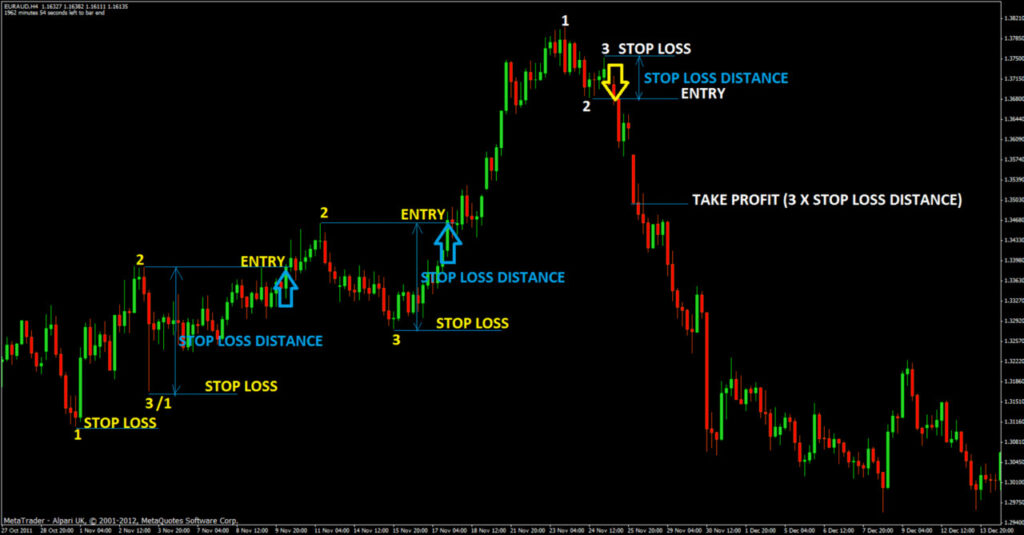

- Stop-Loss Orders: A stop-loss order is an automatic order that closes your position if the price moves against you by a predetermined amount. This helps limit your losses in case the market moves in the opposite direction. By setting a stop-loss, you ensure that you don’t lose more than a set percentage of your trading capital on any given trade.

- Risk-to-Reward Ratio: The risk-to-reward ratio is an essential metric for assessing potential trades. Traders often aim for a ratio of at least 1:2, meaning that for every dollar risked, the potential reward should be at least two dollars. This ensures that even if some trades are unsuccessful, the profitable ones outweigh the losses.

- Leverage Management: While leverage can magnify profits, it can also magnify losses. It’s essential to use leverage responsibly, particularly when trading with automated systems or copy trading. Overleveraging can quickly deplete your account balance, so it’s vital to control how much leverage you use and never risk more than you can afford to lose.

- Diversification: Diversifying your trading strategies or currency pairs can help reduce risk. For instance, rather than focusing on just one currency pair, traders can explore multiple pairs with different market conditions, lowering the impact of a single trade going wrong.

- Position Sizing: Determining the size of each position is another crucial part of risk management. Traders should adjust their position sizes based on their account balance and risk tolerance. By doing so, they can limit the impact of any single trade on their overall portfolio.

How Risk Management Contributes to Passive Income

When you apply effective risk management practices in Forex trading, you protect your capital from large losses and ensure that your passive income strategies remain sustainable. Risk management ensures that you don’t need to constantly monitor every trade or actively intervene in your strategies. By setting up automated trading systems with appropriate risk controls in place, you create a long-term, stable source of income while minimizing your exposure to unpredictable market movements.

How to Start Forex Trading for Passive Income

Choose a Reliable Forex Broker

The first step in starting your journey to Forex trading for passive income is choosing a reliable Forex broker. A good broker will offer access to competitive spreads, low commissions, and efficient execution. Look for brokers that offer automated trading options, copy trading, and strong customer support.

Ensure that the broker is regulated by a reputable authority, such as the Financial Conduct Authority (FCA) or the U.S. Commodity Futures Trading Commission (CFTC), to guarantee security and compliance with industry standards. Many brokers also offer demo accounts, which are perfect for practicing passive trading strategies without risking real money.

Learn the Basics of Forex Trading

Before diving into passive income strategies, it’s essential to familiarize yourself with the basics of Forex trading. Learn about currency pairs, leverage, pips, and how market analysis works. You don’t need to become an expert right away, but having a fundamental understanding of the Forex market will give you confidence in implementing passive income strategies.

Consider taking online courses or reading educational material offered by Forex brokers to strengthen your knowledge of the market. Also, practice using demo accounts to get comfortable with trading platforms and tools.

Decide on a Passive Income Strategy

As discussed earlier, there are several ways to generate passive income through Forex trading, such as automated trading, copy trading, and swing trading. You’ll need to choose the strategy that suits your preferences, risk tolerance, and time availability.

- Automated Trading: Set up Forex trading bots or algorithmic systems that execute trades on your behalf based on predetermined parameters. These systems can run 24/7, making them a perfect option for passive income.

- Copy Trading: Research and select experienced traders to copy through social trading platforms. This allows you to passively follow the trades of skilled professionals and earn passive income without actively managing the trades yourself.

- Swing Trading/Position Trading: Choose a strategy that involves holding trades for longer periods to capture bigger market moves. With swing trading and position trading, you can take a more hands-off approach to Forex trading.

Setup Risk Management Plans

Even when you’re aiming for passive income, risk management should always be a priority. Set up stop-loss orders, determine appropriate leverage levels, and calculate the risk-to-reward ratio for each trade. Effective risk management will ensure that your passive trading efforts remain profitable in the long term and reduce the likelihood of catastrophic losses.

Start Small and Scale Gradually

When starting out, it’s wise to begin with a small trading capital to minimize your exposure to risk. Once you become more comfortable with your strategy and have tested your automated trading systems or copy trading setups, you can gradually scale up your investment. Don’t rush into large trades; focus on consistency and long-term growth.

Monitor and Optimize Your Strategy

While passive income strategies allow you to trade with minimal intervention, it’s still important to periodically review your progress and optimize your trading approach. Monitor your automated trading systems, copy trading results, and the performance of your swing trades to ensure your strategies are still yielding positive results.

Benefits of Forex Trading for Passive Income

Why Forex Trading is an Attractive Passive Income Option

Forex trading offers numerous advantages when it comes to earning passive income. With the ability to trade 24 hours a day and leverage small price movements, it presents a unique opportunity for individuals looking to generate income without actively working. Here are some key benefits of Forex trading for passive income:

Accessibility and Flexibility

One of the most appealing aspects of Forex trading is its accessibility. Unlike traditional investment avenues, such as stocks or real estate, the Forex market operates around the clock, five days a week. This means you can trade at any time that suits your schedule, whether you’re working full-time, studying, or managing other responsibilities. The ability to trade passively through systems like automated trading bots or copy trading allows you to generate passive income without dedicating hours each day to active trading.

High Liquidity

The Forex market is the most liquid financial market in the world, with daily trading volume exceeding $6 trillion. This high liquidity ensures that you can enter and exit trades quickly and at favorable prices. Liquidity also helps minimize the chances of slippage—when the price moves unfavorably between the time a trade is placed and executed—making Forex trading a safer environment for generating passive income.

Low Initial Capital Requirement

Starting in Forex trading generally requires a lower capital investment compared to other forms of trading or investing. Many brokers allow traders to open accounts with as little as $100, and you can leverage your capital through leverage, enabling you to control a larger position than your account balance would normally allow. This low barrier to entry makes Forex trading an ideal option for individuals looking to start earning passive income without a large upfront investment.

Scalability

Forex trading is highly scalable, meaning that as your experience and capital grow, you can scale your trading strategies accordingly. Whether you start with automated trading systems, copy trading, or swing trading. You can gradually increase your position sizes or expand your portfolio to increase your passive income potential. The ability to scale your efforts over time ensures that you can generate more income without dramatically increasing your time commitment.

Diversification

Another significant benefit of Forex trading for passive income is the opportunity for diversification. In Forex, you can trade multiple currency pairs, including major pairs like EUR/USD, GBP/USD, and USD/JPY, as well as exotic pairs that can offer higher volatility and profit potential. Diversifying across different currency pairs or trading styles helps spread risk, which is essential for long-term passive income generation.

Automated Trading

One of the most significant advantages of Forex trading for passive income is the ability to use automated trading systems. These systems, or Forex robots, can execute trades on your behalf based on predefined criteria, such as technical indicators or price action patterns. By automating your trades, you remove the emotional aspect of trading and can allow your strategy to run passively, generating income without constant monitoring.

Challenges and Considerations

Risks Involved in Forex Trading for Passive Income

While Forex trading for passive income offers attractive benefits, it’s essential to be aware of the potential challenges and risks. Understanding these challenges will help you take necessary precautions and set realistic expectations for your passive income goals. Here are some key considerations and challenges in Forex trading:

Market Volatility

The Forex market is known for its volatility. Currency prices can experience significant fluctuations within short timeframes, which can lead to both large profits and substantial losses. Even with automated trading systems or copy trading, there’s no guarantee that the market will move in your favor. It’s important to apply risk management techniques, such as stop-loss orders and position sizing, to mitigate the impact of volatility on your capital.

Overleveraging

While leverage allows you to amplify your profits, it also increases the potential for losses. Many traders fall into the trap of using excessive leverage, thinking that it will accelerate their passive income growth. However, overleveraging can quickly deplete your account balance if the market moves against you. It’s essential to use leverage responsibly and stick to manageable levels to avoid unnecessary risk exposure.

Dependence on Automated Systems

While automated trading can be a great way to earn passive income, it comes with its own set of challenges. These systems are only as good as the algorithms and strategies behind them. If the system is poorly designed or the market conditions change, it could lead to significant losses. Additionally, automated systems can sometimes fail due to technical issues, such as server downtime or internet connection problems. So it’s crucial to monitor your system periodically.

Emotional and Psychological Factors

Even though passive income strategies like copy trading or automated trading can reduce the time and effort you spend on trades, the emotional aspect of trading can still affect your results. Fear, greed, and impatience can cause traders to make impulsive decisions that lead to unnecessary risks. Managing your emotions and setting realistic goals are essential for long-term success in Forex trading.

Time and Effort in Research

Although passive income strategies may seem hands-off, they still require an initial investment of time and effort in research and strategy development. Whether you’re researching the best Forex brokers, studying market trends, or selecting a reputable trader to copy, it’s important to be diligent in your preparations. Without proper research and planning, you may end up with suboptimal results, making it harder to generate consistent passive income.

Regulatory Risks

The Forex market is not always uniformly regulated across all regions, and it’s important to be aware of the legal environment surrounding Forex trading in your country. Some jurisdictions may have stricter regulations. While others may have more relaxed rules, leaving room for less trustworthy brokers. Always choose a regulated Forex broker to ensure your funds are safe and that the broker operates in compliance with industry standards.

Tips for Success in Forex Trading for Passive Income

Maximizing Your Passive Income Potential

To achieve consistent and sustainable passive income through Forex trading, it’s essential to follow a structured approach and implement key strategies. Here are some tips for success in Forex trading for passive income:

Start with a Solid Plan

Before you begin trading, it’s crucial to have a well-defined trading plan. This plan should include clear goals, risk tolerance, strategies, and rules for when to enter and exit trades. A solid plan will help you stay disciplined and avoid impulsive decisions that could hurt your passive income prospects. Set realistic targets and avoid the temptation to chase unrealistic gains.

Utilize Risk Management Techniques

Proper risk management is essential to protect your capital and ensure long-term success in Forex trading. Never risk more than a small percentage of your trading account on a single trade—typically no more than 1-2%. Using tools like stop-loss orders and take-profit levels will help you protect your trades and lock in profits without the need for constant monitoring. Position sizing is another critical aspect of managing risk and ensuring that a string of losing trades doesn’t deplete your account balance.

Start Small and Scale Gradually

It’s wise to begin with a small investment and scale up gradually as you gain experience and confidence. If you’re using automated trading systems or copy trading, start with a conservative capital allocation and test the strategies over time. Scaling your passive income efforts allows you to evaluate the effectiveness of your approach before committing significant capital. Over time, you can adjust your position sizes based on the growth of your account.

Choose the Right Broker and Platform

Selecting a reliable and regulated Forex broker is essential for ensuring the security of your funds and the execution of your trades. Look for a broker with low spreads, a wide range of currency pairs, and advanced tools for both manual and automated trading. The trading platform should be user-friendly and offer comprehensive tools for charting, analysis, and strategy execution.

Diversify Your Trading Strategies

Diversification is key to reducing risk in Forex trading and increasing the potential for passive income. Rather than focusing solely on one currency pair or trading style, consider using a combination of strategies like scalping, swing trading, or position trading. Additionally, using both manual trading and automated systems can provide a balance between hands-on involvement and passive income generation.

Stay Educated and Keep Improving

Forex trading is a dynamic and evolving market. To stay ahead of the curve, continually educate yourself by reading books, following industry news, and learning from more experienced traders. Stay updated on market conditions and economic events that can impact currency prices. The more knowledgeable you are, the better you can adapt to changing market trends and improve your passive income strategies.

Be Patient and Consistent

One of the most important qualities for success in Forex trading is patience. Passive income through Forex is not an overnight success story. It requires consistent effort, proper strategy implementation, and the discipline to stick to your trading plan. Avoid trying to make quick profits, as this can lead to unnecessary risks and emotional decisions. Focus on long-term growth and stability, and the passive income will follow.

Conclusion

Achieving Passive Income Through Forex Trading

Forex trading for passive income is an attractive option for individuals looking to generate consistent earnings without dedicating all their time and energy to active trading. By leveraging automated systems, copy trading, and proper risk management, you can build a reliable source of passive income in the Forex market. However, success requires a disciplined approach, solid planning, and the ability to adapt to changing market conditions.

While the Forex market offers unique opportunities, it’s essential to approach it with realistic expectations and a long-term perspective. By following the tips for success, such as starting small, diversifying your strategies, and continually improving your knowledge, you can maximize your chances of earning passive income in the Forex space. Remember, patience, consistency, and risk management are key to achieving lasting success in Forex trading.

Read more Mastering Advanced Forex Trading Techniques

Frequently Asked Questions

What is Forex Trading for Passive Income?

Forex trading for passive income refers to generating income by trading currencies in the foreign exchange (Forex) market without actively managing every trade. This can be done through automated systems, copy trading, or following predefined trading strategies, allowing you to earn money with minimal active involvement.

Can I Really Earn Passive Income from Forex Trading?

Yes, it is possible to earn passive income from Forex trading. But it requires a solid strategy, disciplined risk management, and the right tools. Using automated trading systems or copy trading can significantly reduce the amount of time and effort required while still generating profits. However, as with any form of trading, there are risks involved, and success takes time and effort to achieve.

How Much Money Do I Need to Start Forex Trading for Passive Income?

You don’t need a large amount of capital to start Forex trading for passive income. Many brokers allow you to open an account with as little as $100 or $200. However, the more capital you have, the more potential for profits you can generate. Start with an amount you can afford to lose and gradually increase your investment as you gain experience.

What Are Automated Trading Systems and How Do They Work?

Automated trading systems (also known as Forex robots) are software programs that execute trades on your behalf based on predefined criteria, such as technical indicators or price action patterns. These systems can help you generate passive income by running automatically, removing the need for manual intervention. However, it’s essential to choose a reputable system and monitor its performance periodically.