Swing Trading vs. Day Trading in Forex

The Forex market is a dynamic and exciting space where traders adopt different strategies to achieve their financial goals. Among these, Swing Trading vs. Day Trading in Forex stand out as two of the most popular approaches. Both have their unique advantages and challenges, making it crucial to understand their differences. Whether you are a seasoned trader or a beginner, knowing which style aligns with your goals can significantly impact your success.

Introduction to Swing Trading vs. Day Trading in Forex

The Forex market is the largest financial market in the world, with trillions of dollars traded daily. This immense liquidity makes it a favorite for traders globally. However, trading in Forex isn’t one-size-fits-all. Traders often choose strategies like Swing Trading or Day Trading, depending on their goals, risk tolerance, and time commitment.

Swing Trading involves holding positions for several days or weeks to capitalize on medium-term price movements. On the other hand, Day Trading requires opening and closing positions within the same trading day to profit from short-term fluctuations. Both strategies cater to different types of traders and require distinct skills, making it essential to evaluate them carefully before deciding on the best fit for you.

What is Swing Trading?

Definition and Overview

Swing Trading is a trading style where traders aim to profit from price swings that occur over several days or weeks. Unlike Day Trading, which focuses on intraday movements, Swing Trading takes advantage of medium-term trends. This approach is well-suited for traders who cannot monitor the markets constantly but still wish to actively engage in trading.

Key Features of Swing Trading

- Timeframe: Swing traders typically hold positions for a few days to weeks.

- Analysis: Both technical analysis and fundamental analysis are crucial.

- Objective: The primary goal is to capture a chunk of a price trend, rather than the entire move.

- Tools Used: Swing traders rely on tools like trendlines, Fibonacci retracements, and moving averages to identify potential trade opportunities.

Pros and Cons of Swing Trading

Advantages:

- Less time-intensive: Swing trading requires less frequent monitoring compared to Day Trading, making it suitable for part-time traders.

- Reduced stress: With fewer trades, traders experience less pressure.

- Higher potential profits per trade: By holding positions longer, traders can capture larger price movements.

Disadvantages:

- Overnight risk: Swing traders are exposed to market risks during non-trading hours, such as news events and economic releases.

- Delayed returns: Swing Trading may take longer to yield profits compared to intraday strategies.

What is Day Trading?

Definition and Overview

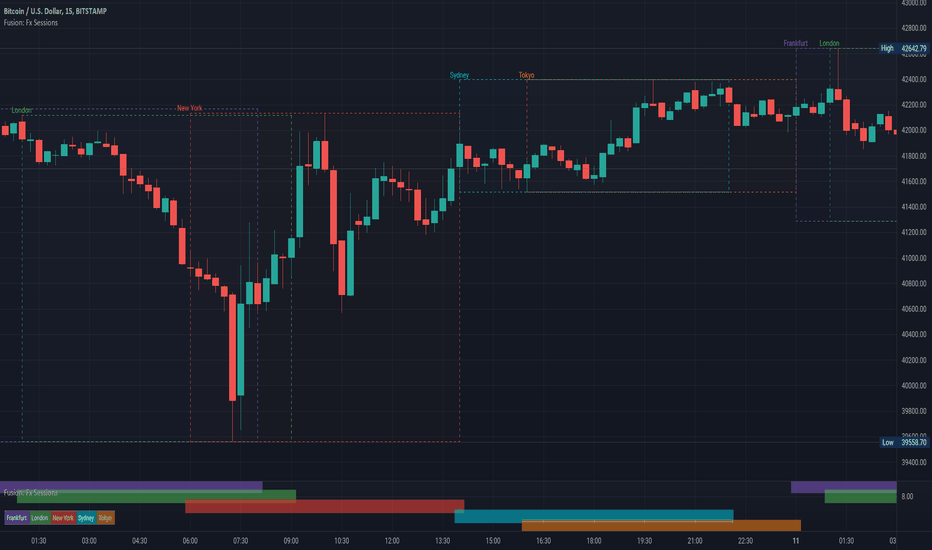

Day Trading is a trading strategy where traders open and close all positions within the same trading day, avoiding overnight exposure to market risks. This approach is ideal for those who want to take advantage of intraday price movements in the highly liquid Forex market. Day traders focus on capturing small but frequent profits through multiple trades during the day.

Unlike Swing Trading, Day Trading requires constant market monitoring and quick decision-making, making it suitable for full-time traders who can dedicate significant time and attention to trading activities.

Key Features of Day Trading

- Timeframe: Positions are typically held for a few minutes to hours but are closed before the market session ends.

- Focus: Intraday volatility and short-term price movements.

- Tools Used: Day traders heavily rely on technical indicators like moving averages, Bollinger Bands, and RSI to identify entry and exit points.

- Frequency: Day traders execute multiple trades daily, aiming for small but consistent gains.

Pros and Cons of Day Trading

Advantages:

- No overnight risk: All trades are closed by the end of the day, avoiding the impact of overnight market changes.

- Quick returns: Day traders can realize profits (or losses) within hours, providing immediate feedback.

- High market engagement: Frequent trades allow traders to stay actively involved in the market.

Disadvantages:

- Time-intensive: Day trading demands constant monitoring and rapid decision-making, which can be stressful.

- Higher transaction costs: Frequent trades lead to higher commissions and spreads, which can eat into profits.

- Steeper learning curve: Requires strong technical skills and a deep understanding of the market.

Swing Trading vs. Day Trading-Key Differences

Trading Timeframe

The most significant difference between Swing Trading and Day Trading lies in the timeframe:

- Swing traders hold positions for days or weeks, aiming to capture medium-term price movements.

- Day traders close all positions within the same day, focusing on intraday price fluctuations.

Risk Management

- Swing Trading involves overnight exposure, making it susceptible to gaps caused by news events.

- Day Trading eliminates overnight risks but demands stricter intraday risk management due to high trade frequency.

Required Skills and Tools

- Swing Trading requires a strong grasp of both technical and fundamental analysis to predict medium-term trends.

- Day Trading demands quick reflexes, real-time decision-making, and expertise in using technical indicators.

Profit Potential

- Swing traders aim for larger profits per trade but may have fewer trading opportunities.

- Day traders focus on smaller, frequent profits, which can accumulate over time.

Time Commitment

- Swing Trading is less time-intensive, making it suitable for part-time traders.

- Day Trading requires full-time dedication, as traders must monitor the market continuously.

Psychological Impact

- Swing Trading can be less stressful due to fewer trades and longer decision windows.

- Day Trading is more demanding mentally, requiring focus and discipline to handle frequent trades and rapid market changes.

How to Choose Between Swing Trading and Day Trading

Factors to Consider

Selecting between Swing Trading and Day Trading depends on several personal and practical factors. Here’s what you need to evaluate:

- Time Availability

- Swing Trading: Ideal for those who have limited time to monitor the market. You only need to check positions once or twice daily.

- Day Trading: Requires full-time attention, making it suitable for traders who can dedicate hours to analyzing and executing trades.

- Risk Tolerance

- Swing Trading: Involves overnight and weekend risks, as positions are held longer.

- Day Trading: Avoids overnight risks but can be stressful due to rapid intraday movements.

- Financial Goals

- If you aim for consistent, smaller profits, Day Trading might be more appropriate.

- If you seek higher gains from medium-term price trends, Swing Trading could be the better choice.

- Trading Experience

- Beginners may find Swing Trading less overwhelming, as it involves fewer trades and longer decision windows.

- Experienced traders with strong analytical and quick decision-making skills may prefer the fast-paced nature of Day Trading.

- Capital Requirements

- Day Trading typically requires higher capital to meet margin requirements and sustain frequent trades.

- Swing Trading allows more flexibility with smaller capital.

Questions to Ask Yourself

Before deciding, ask:

- How much time can I dedicate to trading?

- What is my risk tolerance level?

- Do I prefer frequent trading or longer-term positions?

- Am I comfortable with high-intensity trading sessions?

Swing Trading and Day Trading Strategies

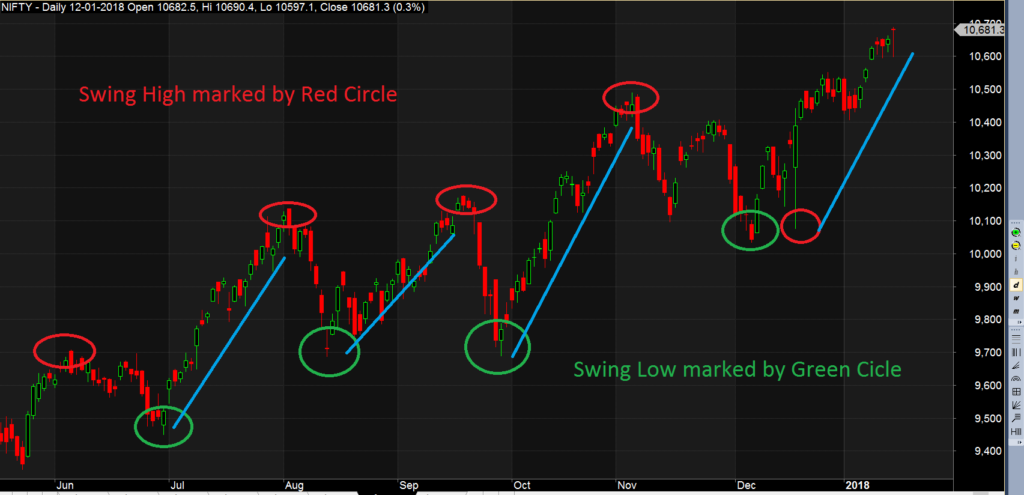

Effective Swing Trading Strategies

- Trend Trading

- Identify a strong trend using indicators like moving averages and RSI.

- Enter trades in the direction of the trend and hold until the trend weakens.

- Support and Resistance Levels

- Use technical analysis to identify key support and resistance zones.

- Buy near support levels and sell near resistance zones to capitalize on price swings.

- Fibonacci Retracement Strategy

- Utilize Fibonacci levels to find retracement points during a trend.

- Enter trades at significant retracement levels, like 38.2% or 61.8%.

- Breakout Trading

- Look for price consolidation patterns, such as triangles or rectangles.

- Enter trades when the price breaks out of these patterns with high volume.

Effective Day Trading Strategies

- Scalping

- Focus on making small, frequent profits by trading short-lived price movements.

- Execute multiple trades within minutes using tools like Bollinger Bands and MACD.

- Momentum Trading

- Trade assets that show strong intraday price momentum, often driven by news or events.

- Use indicators like RSI and moving averages to identify entry points.

- Range Trading

- Identify price ranges during low-volatility periods.

- Buy at support and sell at resistance within the range.

- Breakout and Breakdown Strategies

- Monitor for price breakouts above resistance or breakdowns below support.

- Enter trades as the price moves decisively beyond these levels, with stop-losses to manage risk.

Tools and Platforms for Forex Trading

Choosing the Right Trading Platform

When engaging in Forex trading, having access to the right trading platform is crucial for success. The platform you choose will serve as your gateway to the Forex market, allowing you to analyze trends, execute trades, and manage positions. Here are some key factors to consider when selecting a trading platform:

- User Interface: Choose a platform that is easy to navigate, with customizable charts and indicators.

- Reliability: Ensure the platform is stable and offers minimal downtime, especially during high-volatility trading sessions.

- Supported Assets: Make sure the platform supports the currency pairs you wish to trade.

- Security: Opt for platforms with robust security features to protect your account and personal information.

Popular Forex Trading Platforms

- MetaTrader 4 (MT4)

- The most popular platform for retail Forex traders, MT4 offers powerful charting tools, automated trading capabilities, and customizable indicators.

- MetaTrader 5 (MT5)

- A more advanced version of MT4, MT5 offers additional timeframes, more order types, and a wider range of asset classes.

- cTrader

- Known for its user-friendly interface and fast execution speeds, cTrader is favored by traders who focus on scalping and day trading.

- TradingView

- A web-based platform with advanced charting tools and social features that allow traders to share strategies and analysis.

- NinjaTrader

- Offers advanced analytics and automated trading tools, often used by traders focusing on high-frequency trading and algorithmic strategies.

Forex Trading Tools

- Technical Indicators

- Tools like Moving Averages, Relative Strength Index (RSI), and Bollinger Bands are essential for analyzing market conditions and making informed trading decisions.

- Economic Calendars

- These calendars keep track of economic events that can impact currency prices, such as interest rate decisions, GDP reports, and employment data.

- Risk Management Tools

- Platforms offer features like stop-loss and take-profit orders to manage risk and automate trade exits.

- News Feeds and Market Alerts

- Stay updated with real-time news and price alerts, which are critical for day trading and swing trading to avoid unexpected market movements.

Common Mistakes to Avoid

Overleveraging

One of the biggest mistakes Forex traders make is using excessive leverage. While leverage can amplify profits, it also increases the potential for substantial losses. Traders who overleverage their positions risk blowing up their accounts due to a small price movement in the opposite direction.

- Solution: Use leverage cautiously, and only trade with the amount of capital you can afford to lose.

Lack of a Trading Plan

Trading without a solid plan is like navigating a stormy sea without a compass. Many traders jump into the Forex market impulsively without having clear goals, entry/exit strategies, or risk management rules in place. This often leads to hasty decisions and emotional trading.

- Solution: Develop a detailed trading plan that includes your risk-reward ratio, entry and exit points, and stop-loss levels. Stick to your plan and avoid impulsive decisions.

Chasing the Market

Another common mistake is chasing the market, which occurs when traders enter trades after missing an opportunity, hoping to catch the next move. This often results in entering at unfavorable prices and facing significant drawdowns.

- Solution: Wait for the right setup according to your strategy. Don’t force trades or enter positions out of FOMO (Fear of Missing Out).

Ignoring Risk Management

Risk management is essential for long-term success in Forex trading. Some traders neglect to set stop-loss orders or take-profit levels, exposing themselves to unpredictable market swings that can wipe out their profits.

- Solution: Always use stop-loss and take-profit orders to protect your capital. Only risk a small percentage of your account balance per trade, usually around 1-2%.

Overtrading

Overtrading happens when traders enter too many positions in a short time, often driven by emotions or the desire to make up for previous losses. This can lead to exhaustion, poor decision-making, and significant financial losses.

- Solution: Take breaks and only trade when there’s a clear setup according to your strategy. Avoid trading for the sake of being active in the market.

Conclusion

In conclusion, both Swing Trading and Day Trading offer distinct approaches to trading in the Forex market, and choosing the right method depends on your individual goals, time availability, risk tolerance, and experience level. Swing trading is ideal for those who prefer a more relaxed, medium-term approach, with fewer trades and more time to analyze the market. On the other hand, Day Trading caters to those who can dedicate substantial time to monitor the market, execute quick trades, and thrive in high-volatility environments.

Understanding the key differences, available tools and platforms, and common mistakes to avoid is essential to maximize success in either trading style. No matter which approach you choose, always remember to manage risk effectively, stay disciplined, and continuously educate yourself on market dynamics.

By carefully evaluating your personal preferences and market conditions, you can make a well-informed decision and develop a trading strategy that aligns with your goals. Both Swing Trading and Day Trading have the potential for profitability, but your success will ultimately depend on consistency, strategy, and the ability to adapt to changing market conditions.

Read more Top Scalping Strategies for Forex Beginners

Frequently Asked Questions

What is the difference between Swing Trading and Day Trading?

Swing Trading involves holding positions for several days to capture medium-term trends, while Day Trading focuses on making multiple trades within a single day. Swing traders tend to analyze trends over longer periods, while Day traders rely on quick, intraday price movements.

Which is better for beginners, Swing Trading or Day Trading?

Swing Trading is generally better for beginners because it requires less constant monitoring and allows for more time to make decisions. Day Trading, while potentially more profitable, requires more time, skill, and the ability to react quickly to market movements.

How much money do I need to start Swing Trading or Day Trading?

The amount of capital needed depends on your trading style and risk tolerance. For Swing Trading, you might start with a smaller capital base. However, Day Trading often requires more capital due to higher leverage and frequent trades. It’s important to only trade with money you can afford to lose.

Can I use the same strategies for Swing Trading and Day Trading?

While some strategies can be applied to both Swing Trading and Day Trading, the timeframe and frequency of trades differ. For example, technical analysis and chart patterns work for both styles, but Day Trading may focus more on short-term price action and momentum, while Swing Trading focuses on capturing medium-term trends.

How do I manage risk in both Swing Trading and Day Trading?

Managing risk is crucial in both styles. Use tools like stop-loss and take-profit orders to limit losses and secure profits. Risking only a small percentage of your total capital per trade (typically 1-2%) is a smart strategy to prevent large losses.