Top Forex Tools for Advanced Traders

In the fast-paced world of forex trading, advanced traders rely on a range of tools to refine their strategies, improve accuracy, and maximize profits. Whether you’re looking to analyze market trends, manage risk, or automate trades. The right tools can make all the difference. In this guide, we’ll explore the Top Forex Tools for Advanced Traders designed for experienced traders. Who are looking to stay ahead of the curve and make more informed decisions in the dynamic forex market.

Top Forex Trading Tools for Advanced Traders

In the ever-evolving world of Forex trading, success is often determined by the tools you use. For advanced traders, relying on basic strategies and platforms simply isn’t enough. In this article, we will explore the top Forex trading tools that can elevate your trading game. These tools offer advanced features, such as real-time data, technical analysis, risk management, and automated trading. Which can significantly enhance your trading efficiency and decision-making process. If you are serious about taking your trading to the next level. Understanding and utilizing the best tools available is essential. Let’s dive into what Forex trading tools are and how they can help you become a more proficient trader.

What Are Forex Trading Tools?

Forex trading tools refer to a variety of software, platforms, and systems that traders use to analyze the Forex market, make informed decisions, and execute trades. These tools provide traders with insights into market conditions, price movements, and potential trading opportunities. For advanced Forex traders, the use of specialized tools becomes critical. As it helps to manage trades more effectively and stay ahead of market trends.

In general, Forex tools can be categorized into technical analysis tools, fundamental analysis tools, trading platforms, and risk management tools.

- Technical Analysis Tools: These tools allow traders to study price charts, indicators, and patterns to predict future price movements. Examples include Moving Averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence).

- Fundamental Analysis Tools: These tools focus on the underlying factors that influence market movements, such as economic calendars, news feeds, and GDP data. Fundamental analysis helps traders understand the bigger picture, like the impact of interest rate changes or geopolitical events on the Forex market.

- Trading Platforms: Platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5) provide traders with all the tools needed for placing orders, setting stop-loss levels, and executing trades. They often include features for charting, backtesting strategies, and automated trading.

- Risk Management Tools: Advanced traders use risk management tools like trade calculators, stop-loss orders, and take-profit levels to minimize losses and maximize profits. These tools help manage the amount of capital at risk and protect against market volatility.

By leveraging the right Forex trading tools, advanced traders can make smarter. Data-driven decisions, which ultimately enhances their chances of success. As the Forex market is highly volatile, relying on the right tools helps in maintaining a competitive edge and minimizing risks.

Key Features of Advanced Forex Trading Tools

When selecting advanced Forex trading tools, it’s important to focus on the key features that will give you an edge in the highly competitive Forex market. These features enhance the functionality of the tools, making them more suitable for advanced traders who rely on precision, speed, and comprehensive analysis. Below are the crucial elements that advanced Forex tools must offer:

Real-time Market Data

The most essential feature of any Forex trading tool is real-time market data. Advanced traders need to access up-to-the-minute information on currency pair prices, volume, and market sentiment. This ensures they can make timely decisions, taking advantage of short-term price fluctuations. The ability to view live data and market news instantly is crucial for executing high-frequency trades or identifying emerging trends.

Customizable Charting & Technical Indicators

Charting tools are at the core of technical analysis. Advanced traders use customized charts to study price action and recognize patterns that could signal profitable trading opportunities. These charts allow traders to modify timeframes, add technical indicators like RSI, Bollinger Bands, or Fibonacci retracements, and tailor visualizations to their trading style.Customization is key—whether you need to display candlestick patterns, use multiple chart types, or implement complex indicator combinations, advanced tools must allow for flexibility.

Automated Trading and Algorithmic Capabilities

For those who prefer automated trading, the ability to create, test, and deploy trading algorithms is vital. Advanced Forex trading tools support Expert Advisors (EAs) and algorithmic trading, enabling traders to set up rules for entering and exiting trades based on predefined conditions. This removes emotional bias from the trading process and allows for quicker execution of strategies, especially in volatile markets.

Multi-timeframe Analysis

Advanced traders often use multi-timeframe analysis to analyze price movements across different chart periods simultaneously. This helps identify larger trends while keeping an eye on shorter-term opportunities. For example, a trader might analyze the daily chart for long-term trends, the 4-hour chart for mid-term entries, and the 1-hour chart for more immediate trade decisions. Having the ability to view multiple timeframes in a single interface allows for more comprehensive analysis.

Risk Management Features

Effective risk management is essential for maintaining long-term profitability. Advanced trading tools should include stop-loss orders, take-profit levels, and position-sizing calculators. These features allow traders to set predetermined limits on their losses and profits, helping to safeguard capital in volatile markets. Advanced tools may also offer trailing stops that adjust stop levels as the market moves in a favorable direction.

Backtesting and Strategy Development

Another crucial feature is backtesting, which allows traders to test their strategies using historical market data. This helps verify the effectiveness of a strategy before applying it in live markets. Strategy development tools enable traders to create, test, and refine their approaches, increasing their confidence when it comes time to execute them.

Top Forex Trading Tools for Advanced Traders

The right Forex trading tools can make all the difference in maximizing profit potential and minimizing risks in the highly competitive Forex market. Below are some of the top Forex trading tools that every advanced trader should consider integrating into their strategy:

MetaTrader 4/5 (MT4/MT5)

MetaTrader 4 and 5 are widely regarded as the gold standard for Forex trading platforms. They offer a range of features that are ideal for advanced traders, including:

- Custom indicators and scripts for more sophisticated market analysis.

- Automated trading capabilities through Expert Advisors (EAs), which allow traders to set up rules for executing trades without manual intervention.

- Backtesting tools for testing strategies based on historical data.

- Multiple charting options and timeframes for in-depth market analysis.

- Order management features to place, modify, and track trades efficiently.

MetaTrader is the preferred platform for professional Forex traders due to its comprehensive capabilities and ease of integration with third-party tools and brokers.

TradingView

TradingView is another powerful platform that’s gained popularity among advanced traders for its intuitive interface and advanced charting capabilities. Key features include:

- Cloud-based charts that allow for easy access from anywhere.

- Multiple chart layouts, making it ideal for multi-timeframe analysis.

- Social trading features that enable traders to share their strategies and insights with the global community.

- Custom scripts and indicators through Pine Script for tailored analysis.

- Real-time market news and economic calendar features, helping traders stay updated with relevant events.

With its combination of advanced charting tools and social trading features, TradingView is a great choice for traders who like to share their knowledge while using top-tier analysis tools.

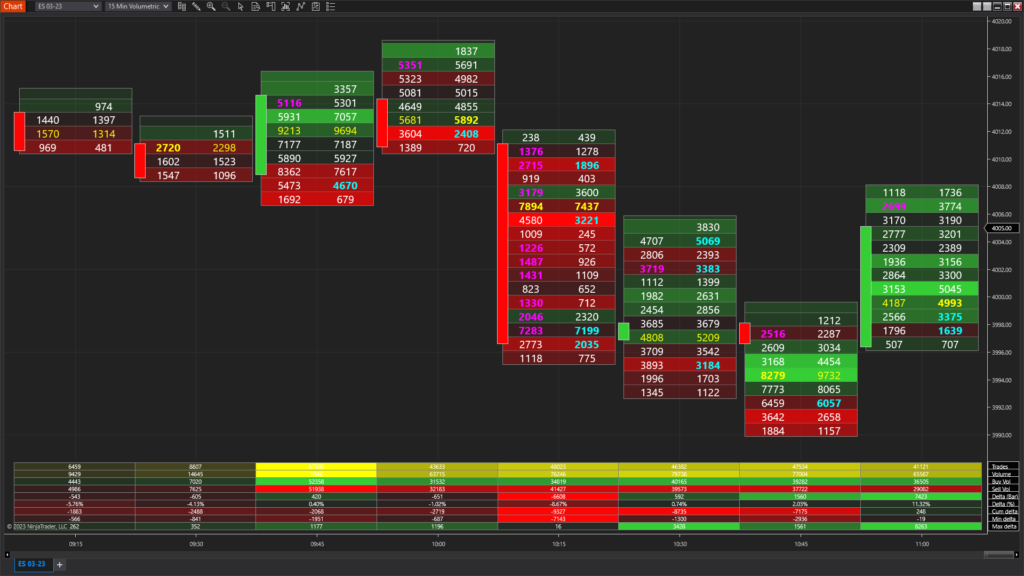

NinjaTrader

NinjaTrader is a robust platform, especially favored by advanced Forex traders who want to trade futures and Forex. Key features include:

- High-speed execution for low-latency trading, critical for fast-moving markets.

- Advanced order entry and exit strategies, enabling traders to precisely manage trades.

- Powerful strategy development tools for backtesting and optimization.

- Access to a large library of custom indicators and automated strategies.

- Integration with multiple data feeds and brokers for a seamless trading experience.

The high-performance capabilities of NinjaTrader make it an ideal platform for traders who require precision and fast execution, especially in volatile market conditions.

cTrader

cTrader is known for its user-friendly interface and advanced trading features. It offers:

- One-click trading for quick entry and exit points.

- Algorithmic trading through cAlgo, where traders can create custom trading robots.

- A range of advanced charting tools with multiple indicators and customizable layouts.

- The ability to perform multi-timeframe analysis for a well-rounded market view.

Additional Tools to Consider

While the primary tools mentioned above are vital for any advanced Forex trader, there are several additional tools that can enhance trading strategies, improve market analysis, and streamline the trading process. These extra tools can add significant value depending on your individual needs and trading style.

Economic Calendar

An economic calendar is an essential tool for traders who rely on fundamental analysis. This calendar tracks important economic events such as interest rate decisions, GDP releases, unemployment data, and central bank statements. Advanced traders use this tool to anticipate market-moving events that could significantly impact currency pairs. Knowing when these events occur helps traders plan their trades around market volatility.

For example, if a U.S. Federal Reserve meeting is scheduled, traders might avoid trading in the hour leading up to the announcement to mitigate potential risks. A good economic calendar tool includes real-time updates, historical data, and the ability to filter events based on importance or region.

Forex Signal Providers

Forex signal providers offer insights and trade signals based on technical and fundamental analysis. These services deliver recommendations for buying and selling currency pairs, helping traders identify potential opportunities without having to constantly monitor the market. Advanced traders may use signals as a supplement to their analysis, confirming their own strategies or ideas.

However, it’s essential to choose a reliable Forex signal provider with a proven track record. Signal providers can be either manual (human traders providing insights) or automated (based on algorithms).

Trade Copying Platforms

For traders who prefer a more passive approach, trade copying platforms allow them to copy the trades of experienced or successful traders. These platforms allow users to follow specific traders and replicate their trades automatically. It’s a great way for advanced traders to diversify their portfolio and learn from others while minimizing the time spent analyzing the markets.

Virtual Private Server (VPS)

A VPS is a remote server that traders can rent to run their trading platforms without interruption. It provides fast execution speeds and the ability to keep trading 24/7, even when your computer is turned off. A VPS is especially beneficial for algorithmic traders who rely on automated strategies that need to run continuously without downtime.

Many brokers offer VPS services to traders who have specific requirements, such as low-latency execution or the need to run Expert Advisors (EAs) seamlessly.

Forex News Aggregators

Forex news aggregators are tools that consolidate news from multiple reliable sources, including economic reports, central bank announcements, and geopolitical developments. These tools help traders stay informed in real-time, enabling them to react quickly to changing market conditions. Some advanced news aggregators even provide sentiment analysis, giving traders a clear picture of how the market is reacting to breaking news.

Tools like Forexlive and DailyFX offer comprehensive news feeds, economic data releases, and analysis for Forex traders.

How to Choose the Right Trading Tool for You

Selecting the right Forex trading tool can be challenging, especially with the variety of options available to advanced traders. Each trader has unique preferences, strategies, and needs. Here’s a comprehensive guide on how to choose the right tool to maximize your trading potential.

Define Your Trading Goals

The first step in selecting the right tool is to define your trading goals. Are you focusing on technical analysis, fundamental analysis, automated trading, or manual trading? Different tools are designed to cater to different goals:

- Technical analysis tools like MetaTrader or TradingView are best for charting and indicator-based trading.

- Fundamental analysis tools like economic calendars or news aggregators are more suited for traders who rely on market events and news.

- If you prefer automated trading, choose platforms that support Expert Advisors (EAs) or algorithmic strategies.

Assess Your Experience Level

As an advanced trader, you’re likely already familiar with basic tools and platforms. However, as you move to more sophisticated strategies, tools that offer customization, advanced charting, and automated features will be more beneficial. Look for platforms that allow you to create and implement custom indicators and strategies. For example, MetaTrader and cTrader offer this flexibility, making them ideal for traders who want to go beyond the basics.

If you are newer to Forex trading, tools with a user-friendly interface may be more suitable until you become more comfortable with advanced features.

Look for Real-time Data and Reliability

Accuracy and real-time data are crucial for making informed trading decisions. Advanced traders rely on the timeliness and precision of the data they receive. Make sure the tool you choose provides live data feeds with low latency, and check the reliability of the provider, especially if you’re using automated systems or algorithmic trading strategies.

A VPS can be a great addition to ensure that your trading platform remains online and connected without any interruptions.

Evaluate Risk Management Features

When trading in volatile markets, risk management is essential. Choose tools that offer stop-loss orders, take-profit levels, and the ability to calculate position sizes. These features ensure that you can control your exposure and manage your capital effectively. Additionally, many platforms offer features like trailing stops and position tracking, which can help mitigate risks while maximizing potential returns.

Consider Cost and Fees

Finally, consider the costs associated with each tool. Many advanced tools come with additional fees, whether it’s a subscription fee for economic calendars, news aggregators, or VPS services. Additionally, broker fees and spread costs can affect your overall trading expenses. While it’s essential to invest in quality tools, it’s equally important to assess the value they provide in terms of features and performance compared to the cost.

Conclusion

In conclusion, Forex trading tools are indispensable for advanced traders looking to enhance their trading strategies, increase accuracy, and streamline decision-making. These tools range from technical analysis platforms to automated trading systems, and they help traders better understand the market and make more informed decisions. As an advanced trader, choosing the right tools—whether it’s for risk management, market analysis, or automation—is crucial to your success in the Forex market.

With the variety of options available, it’s important to assess your individual trading needs. Whether you focus on technical analysis, fundamental analysis, or algorithmic trading, there’s a tool designed to complement your approach. By investing in high-quality, reliable tools that align with your goals, you can improve your efficiency and effectiveness as a Forex trader. Additionally, using advanced tools such as economic calendars, VPS, and trade copying platforms can give you a competitive edge, helping you stay ahead of market trends and make quick decisions.

Read more How to Trade Forex Using Economic Calendars

Frequently Asked Questions

What are the most important tools for advanced Forex traders?

For advanced Forex traders, the most essential tools include charting platforms (like MetaTrader or TradingView), economic calendars, risk management tools, VPS services, and automated trading software. These tools help with market analysis, trade execution, and automation, which are crucial for effective trading strategies.

How do I choose the best Forex trading tool for me?

Choosing the best Forex trading tool depends on your trading style and goals. If you focus on technical analysis, tools like MetaTrader 4/5 or TradingView are ideal. If you prefer fundamental analysis, an economic calendar or news aggregator will be useful. Consider the cost, data accuracy, and available features when making your decision.

What is the role of an economic calendar in Forex trading?

An economic calendar tracks important economic events that could affect the Forex market. For advanced traders, it helps in anticipating market-moving events such as interest rate decisions, GDP releases, and unemployment data, allowing them to plan their trades around potential volatility.

How do Forex signal providers help traders?

Forex signal providers offer trade recommendations based on technical and fundamental analysis. These signals can be used to guide trading decisions, helping traders spot potential opportunities. Some traders use signal providers as a supplement to their own analysis, while others rely on them entirely.

Is it necessary to use a VPS for Forex trading?

A VPS (Virtual Private Server) is not mandatory, but it can be highly beneficial, especially for automated trading. A VPS ensures your trading platform remains connected and active 24/7 without interruptions, providing faster execution and reduced latency—ideal for algorithmic traders or those who need reliable performance around the clock.