Top Scalping Strategies for Forex Beginners

Forex scalping is a popular trading strategy where traders aim to make small, quick profits by entering and exiting the market multiple times throughout the day. This method works well for beginners, as it does not require large capital investments. But demands skill, discipline, and a solid understanding of market movements. In this article, we will delve into scalping strategies for Forex beginners. Explaining the basics, how scalping works, and tips for becoming a successful scalper in the Forex market.

What is Forex Scalping?

Forex scalping is a trading strategy that focuses on making a large number of trades with small profit margins. Scalpers typically aim to capture small price movements in the market, often lasting for just a few seconds to minutes. The goal is to accumulate many small gains throughout the day, leading to a significant total profit by the end of the trading session.

Unlike long-term traders who hold positions for days or weeks, scalpers execute a high volume of trades within short time frames, usually within a day. The key to successful Forex scalping is speed, as scalpers need to enter and exit the market swiftly to maximize small profits.

Why Scalping is Ideal for Beginners

Scalping can be an attractive strategy for beginners for several reasons:

- Low Initial Capital Requirement: Unlike other trading strategies that require a large initial investment, scalping can be done with small amounts of capital, making it accessible to beginner traders.

- Limited Risk Exposure: Since scalpers make quick trades, their exposure to market risks is limited compared to long-term traders.

- Learn Quickly: Scalping helps beginners understand market dynamics and price action more quickly due to the rapid execution of trades.

However, it is essential for beginners to practice risk management and use proper stop-loss orders to avoid large losses. With proper training, Forex scalping can become a highly effective strategy for beginners.

How Scalping Works in Forex Trading

Forex scalping works by capitalizing on small price movements in highly liquid currency pairs. This trading style involves placing multiple trades throughout the day to accumulate small profits. Here’s how it works:

- Quick Market Movements

Scalpers take advantage of minor price fluctuations in the Forex market. Currency pairs can move in small increments, and scalpers aim to enter the market at the right moment to profit from these small movements. These small price changes can be anywhere from 2 to 10 pips (a pip is a standard unit of measurement in Forex trading). - Short-Term Trades

Scalping is characterized by very short time frames. Scalpers usually execute trades that last only a few seconds to a few minutes. Time frames such as the 1-minute or 5-minute charts are commonly used by scalpers to spot entry points. - Speed of Execution

One of the critical elements of successful Forex scalping is speed. Scalpers need to be able to enter and exit the market in a fraction of a second. The faster you can place trades, the higher your chances of success. - Leveraging Technology

Many scalpers use automated trading systems or Forex scalping robots to speed up trade execution. These tools help to open and close positions quickly, reducing the manual effort involved and improving precision in entering profitable trades. - Market Liquidity

Scalpers typically focus on highly liquid currency pairs, such as the EUR/USD, GBP/USD, or USD/JPY. These pairs have high trading volumes and tight bid-ask spreads, which makes it easier for scalpers to enter and exit the market at favorable prices.

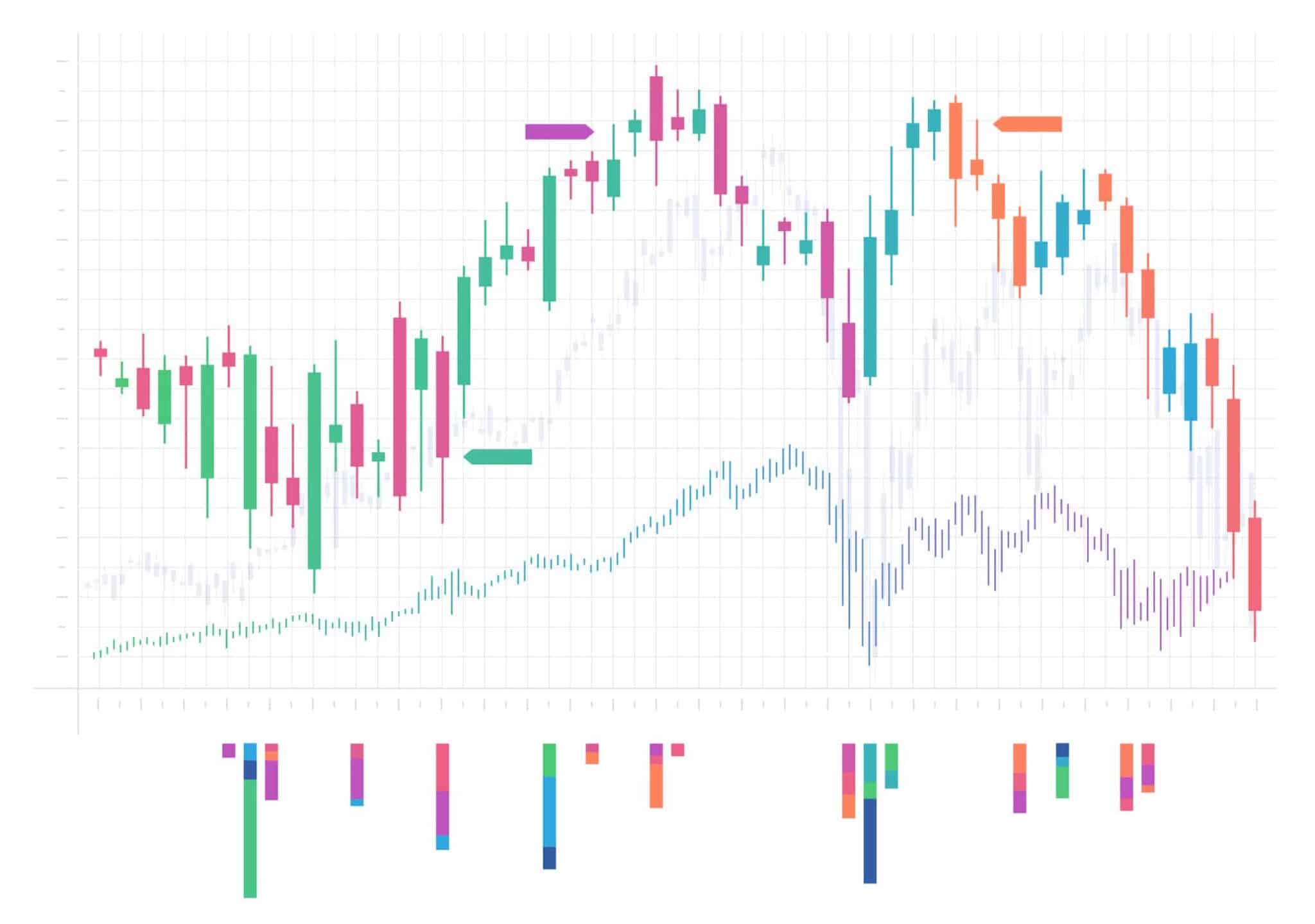

The Role of Time Frames in Scalping

In scalping, the time frame plays a vital role in determining entry and exit points. Short time frames, such as the 1-minute, 5-minute, or 15-minute charts, are ideal for scalping. These time frames help scalpers spot small price changes in real-time and execute trades quickly.

The idea behind using short time frames is to take advantage of micro-price movements, which are much less noticeable on longer time frames, such as the 1-hour or 4-hour charts. Scalpers rely on price action, technical indicators, and market patterns within these short time frames to make quick, profitable trades.

Key Characteristics of Scalping Strategies

Scalping is a distinct Forex trading strategy with specific features that make it unique and effective. Understanding these key characteristics is essential for beginners who want to adopt scalping strategies for Forex. Here are some fundamental aspects of scalping:

Fast Market Movements

Scalpers thrive on quick price movements, making fast market fluctuations a central characteristic of their strategy. These traders aim to capitalize on small price changes that happen frequently throughout the day. Scalpers do not wait for large price swings like long-term traders; instead, they take advantage of rapid price movements over a short period.

Small Profit Margins

One of the defining features of scalping is that traders aim for small profit margins on each trade. These profits usually range between 1-10 pips per trade, but when executed correctly, they can accumulate to significant profits over time. The goal is not to make large profits from individual trades but to consistently achieve small wins that add up.

High Frequency of Trades

Scalping requires executing a high frequency of trades throughout the day. A scalper may open and close multiple positions within minutes or even seconds. The more trades they make, the higher the chances of accumulating profits. For beginners, managing many trades efficiently can be challenging, but with practice, it becomes easier.

Short Holding Period

Scalpers do not hold their positions for long. Trades last anywhere from a few seconds to a few minutes, with some scalpers making dozens or even hundreds of trades in a day. This short holding period reduces exposure to market risks and keeps scalpers in control of their positions.

Focus on Liquid Markets

Scalpers prefer highly liquid currency pairs, such as EUR/USD, GBP/USD, or USD/JPY. These pairs have a large amount of trading volume, which ensures that scalpers can enter and exit the market quickly at favorable prices. The high liquidity also ensures tight bid-ask spreads, making it easier for scalpers to make small profits with minimal slippage.

Leverage and Risk Management

Due to the small profit margins, scalpers often use leverage to maximize their returns. However, leverage can amplify risk, so it is crucial for scalpers to practice solid risk management. Using tight stop-loss orders and setting realistic profit targets are essential practices in successful scalping.

Popular Scalping Strategies for Beginners

When starting with scalping strategies for Forex, beginners should focus on simple yet effective strategies that provide a high probability of success. Below are some of the most popular scalping strategies for beginners:

1-Minute Scalping Strategy

The 1-minute scalping strategy is one of the simplest and most effective strategies for beginners. This strategy involves using the 1-minute chart to capture small price movements.

- How it works: Scalpers use this strategy to enter trades based on minute price fluctuations. The idea is to look for support and resistance levels, as well as trend indicators, to spot quick price changes.

- Pros: It’s easy to understand and use, making it perfect for beginners. The trades are very short, which minimizes exposure to risk.

- Cons: It requires rapid decision-making and can be intense, requiring high concentration and fast execution.

Moving Average Cross Strategy

The moving average cross strategy is a popular scalping strategy that uses two moving averages to spot potential trading opportunities. The most common moving averages used are the 50-period and 200-period simple moving averages (SMA) or exponential moving averages (EMA).

- How it works: The strategy is based on the idea that when the short-term moving average crosses above the long-term moving average, it signals a buy opportunity. Conversely, when the short-term moving average crosses below the long-term moving average, it signals a sell opportunity.

- Pros: It’s simple to use and can be automated. The moving average cross provides clear entry and exit signals.

- Cons: It may generate false signals during sideways or choppy market conditions.

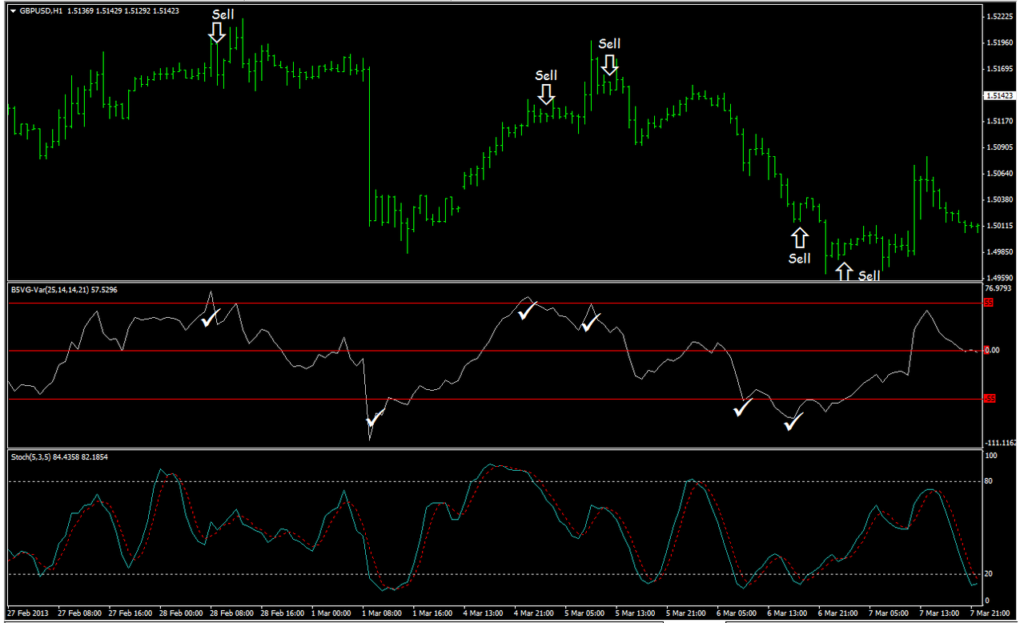

The Stochastic Oscillator Scalping Strategy

The stochastic oscillator is a momentum indicator that compares the closing price of a currency pair to its price range over a specific period. This strategy is ideal for scalpers who want to catch quick reversals based on overbought or oversold conditions.

- How it works: The stochastic oscillator is used to identify when a currency pair is overbought (above 80) or oversold (below 20). Scalpers can look for buying opportunities when the oscillator moves from the oversold region to the upside and sell signals when it moves from the overbought region to the downside.

- Pros: The stochastic oscillator is great for identifying reversals, which is crucial for scalping.

- Cons: It may not always work well in trending markets, as it tends to work better in sideways or range-bound conditions.

Bollinger Bands Scalping Strategy

Bollinger Bands consist of three lines: the middle line (simple moving average), the upper band, and the lower band. The bands are set two standard deviations away from the middle line, and they contract or expand based on market volatility.

- How it works: The Bollinger Bands strategy focuses on price movements relative to the bands. Scalpers often buy when the price touches or goes below the lower band and sell when the price touches or exceeds the upper band.

- Pros: This strategy works well during volatile market conditions and helps to identify breakout points.

- Cons: It may not be as effective during low-volatility periods, where price moves tend to be more subdued.

Tools and Indicators for Effective Forex Scalping

Successful Forex scalping requires the use of tools and indicators that help scalpers identify quick trading opportunities, monitor price movements, and execute trades with precision. Beginners should familiarize themselves with these essential tools and indicators for effective scalping strategies. Here are some of the most useful tools and indicators:

Moving Averages

Moving averages are one of the most commonly used tools in Forex scalping. They smooth out price data and help traders identify trends in the market.

- Simple Moving Average (SMA): The SMA is the average price of a currency pair over a specific time period. It helps scalpers determine the direction of the market.

- Exponential Moving Average (EMA): The EMA gives more weight to recent price movements, making it more responsive than the SMA. It’s highly favored by scalpers for short-term trend detection.

How they help: Moving averages provide entry and exit points for scalpers. When the price crosses the moving average, it often signals a good time to enter a trade. The 50-period EMA and 200-period SMA are commonly used to spot trend reversals or continuations.

Bollinger Bands

Bollinger Bands consist of a middle simple moving average (SMA) and two outer bands that represent standard deviations above and below the SMA. These bands expand and contract with market volatility.

How they help: Bollinger Bands are used to identify overbought or oversold conditions. When the price touches the upper band, it may be overbought, signaling a potential sell. When the price touches the lower band, it may be oversold, signaling a potential buy. Scalpers use Bollinger Bands to catch quick price reversals during periods of low or high volatility.

Relative Strength Index (RSI)

The RSI is a momentum oscillator that helps identify overbought and oversold conditions in the market. It ranges from 0 to 100 and is typically used with a 14-period setting.

How it helps:

- When the RSI is above 70, the market is considered overbought, which may indicate a potential selling opportunity.

- When the RSI is below 30, the market is considered oversold, signaling a potential buying opportunity.

Scalpers use the RSI to spot potential entry points when the market is overbought or oversold, making it a key tool in scalping strategies.

Stochastic Oscillator

The Stochastic Oscillator is another momentum indicator that compares the closing price of a currency pair to its price range over a set period. It moves between 0 and 100.

How it helps:

- When the stochastic oscillator is above 80, the market is overbought.

- When it is below 20, the market is oversold. Scalpers use this tool to identify potential reversal points. The stochastic works well for catching quick price changes, which is vital for scalping.

Fibonacci Retracement Levels

Fibonacci retracement levels are a series of horizontal lines that indicate potential support and resistance levels. They are derived from the Fibonacci sequence and are widely used in technical analysis.

How they help:

Scalpers use Fibonacci retracement levels to identify potential entry points during a price pullback. These levels act as support or resistance, and when the price approaches a Fibonacci level, it often reverses, providing an opportunity for scalpers to make small profits.

Risk Management in Scalping

While Forex scalping can be highly profitable, it also involves significant risk due to the high frequency of trades and small profit margins. Proper risk management is essential for scalpers, especially for beginners who may not be accustomed to the volatility and rapid pace of this trading style. Here are some key risk management practices for successful scalping:

Setting Stop-Loss Orders

A stop-loss order is a risk management tool that helps limit potential losses on a trade. It automatically closes a position when the price moves against the trader by a specified amount.

How it helps:

- For scalpers, it is crucial to set tight stop-loss orders to prevent significant losses from rapid price movements. The goal is to protect your capital while minimizing the risk of large losses in case the market moves unexpectedly.

- Beginners should avoid using wide stop-loss settings, as this can expose them to higher risks in scalping strategies.

Implementing Proper Position Sizing

Position sizing is the process of determining the size of each trade based on the account balance and the level of risk. Scalpers should use proper position sizing to ensure they are not risking too much on any single trade.

How it helps:

- Proper position sizing ensures that losses remain manageable. Beginners should risk only a small percentage of their account balance (typically 1-2%) on each trade to avoid devastating losses.

- For example, if a scalper has a $1,000 account, they should risk no more than $10-$20 on a single trade. This helps maintain consistent trading without risking the entire account on a few bad trades.

Using a Risk-to-Reward Ratio

A risk-to-reward ratio is the amount of risk a trader is willing to take compared to the potential reward. For scalping, it is important to maintain a favorable risk-to-reward ratio to ensure that profits outweigh losses over time.

How it helps:

- A common risk-to-reward ratio for scalpers is 1:2 or 1:3, where the potential reward is twice or three times the amount of risk.

- By maintaining a positive risk-to-reward ratio, scalpers can increase the likelihood of profitability, even with a low win rate.

Avoid Overtrading

Overtrading is one of the biggest mistakes beginners make in Forex scalping. It occurs when a trader takes too many trades, often out of impatience or excitement, leading to increased risk exposure.

How it helps:

- Scalpers should stick to their trading plan and only execute trades that meet their criteria. Overtrading increases transaction costs and can lead to impulsive decisions that result in losses.

- It’s important for scalpers to remain patient and not feel compelled to trade constantly.

sing Automated Trading Systems

Many scalpers use automated trading systems or scalping robots to help execute trades quickly and efficiently. These systems are designed to take advantage of market conditions and make split-second decisions.

How it helps:

- Automated systems can help reduce emotional decision-making and maintain discipline, which is crucial for effective risk management.

- However, it’s essential for beginners to thoroughly test these systems and use them in conjunction with manual oversight to ensure optimal performance.

Common Mistakes to Avoid in Forex Scalping

Forex scalping can be highly profitable, but beginners often make mistakes that can lead to significant losses. Identifying these mistakes and learning how to avoid them is crucial for success. Here are some of the most common mistakes traders make when scalping in the Forex market:

Ignoring Market Conditions

One of the most common mistakes made by Forex scalpers is ignoring overall market conditions. Scalping works best in trending markets where price movements are consistent. Trading in a sideways market (range-bound market) can lead to losses, as price action tends to be unpredictable and difficult to trade in such conditions.

How to Avoid:

- Scalpers should only trade during active market hours, such as during overlapping trading sessions like the London-New York session overlap. This ensures better liquidity and clearer price movements.

- Monitor the overall market trend before initiating any trades. Trade with the trend to increase the chances of successful scalps.

Overtrading

Many beginners are tempted to trade frequently, believing that more trades equal more profit. However, overtrading can lead to significant losses due to transaction costs and emotional fatigue.

How to Avoid:

- Stick to a plan: Set clear rules for when to enter and exit trades. Only trade when there is a clear opportunity according to your trading strategy.

- Focus on quality, not quantity. Avoid taking unnecessary trades, as overtrading can deplete your capital quickly.

Poor Risk Management

Effective risk management is crucial for long-term profitability in Forex scalping. Many scalpers either risk too much on each trade or fail to set proper stop-loss orders, leading to large losses.

How to Avoid:

- Set tight stop-loss orders to limit potential losses. Ensure that the risk-to-reward ratio is in your favor, ideally 1:2 or better.

- Control your position size to avoid risking too much of your capital on a single trade. Only risk a small percentage (1-2%) of your trading capital per trade.

Letting Emotions Take Over

Emotional trading is a major pitfall in Forex scalping. Emotions such as greed, fear, and frustration can cloud judgment and lead to impulsive trading decisions, resulting in losses.

How to Avoid:

- Stick to your strategy: Do not let emotions guide your trading decisions. Follow your trading plan and avoid chasing after every small price movement.

- Take breaks: If you feel overwhelmed or frustrated, take a step back and return to the charts when you’re in a clearer state of mind.

Using Too Many Indicators

Another common mistake is using too many indicators at once, leading to information overload. While indicators are useful tools, relying on too many can cause confusion and reduce the effectiveness of scalping strategies.

How to Avoid:

- Focus on a few reliable indicators that you understand well and that complement each other. Use moving averages, RSI, or Bollinger Bands, but avoid cluttering your charts with too many signals.

- Always test your indicators before using them in live trading.

Tips for Success in Forex Scalping

Forex scalping requires a disciplined approach, sound risk management, and the ability to make quick, informed decisions. To improve your success rate in scalping strategies, here are some valuable tips:

Stick to a Proven Strategy

Having a solid scalping strategy is essential for success. Whether you use a trend-following approach or a mean reversion strategy, ensure your plan is proven and works consistently. Backtest your strategy before implementing it in the live market.

Tip for Success:

- Follow a well-established trading system that includes clear entry and exit signals. Avoid jumping between strategies, as consistency is key to profitable scalping.

Focus on One Currency Pair

As a beginner, it’s best to focus on just one or two currency pairs when scalping. This allows you to become familiar with their price movements and volatility patterns, making it easier to spot scalping opportunities.

Tip for Success:

- Stick to major currency pairs such as EUR/USD, GBP/USD, or USD/JPY, as these pairs tend to have higher liquidity and lower spreads, which are ideal for scalping.

Practice Patience and Discipline

Scalping is not about rushing into trades but about waiting for the right opportunities. Patience and discipline are critical for scalping success. Stick to your trading rules, and don’t fall for the temptation to take trades out of boredom or excitement.

Tip for Success:

- Be patient and wait for your setup to unfold. Don’t chase the market or force trades. Quality trades lead to more consistent profitability.

Use a Reliable Broker

To be successful at Forex scalping, you need a broker that offers tight spreads, fast execution, and low commissions. A reliable broker is critical for quick order execution, as delays can impact your ability to scalp effectively.

Tip for Success:

- Research and choose a broker that is known for its high-quality customer service and fast execution speed. Also, ensure that your broker offers a low spread to reduce transaction costs.

Keep Learning and Adapting

The Forex market is constantly evolving, and successful scalpers continuously learn and adapt to changing market conditions. Always analyze your trades and learn from your mistakes.

Tip for Success:

- Review your scalping performance regularly. Keep a trading journal to track your results and identify areas where you can improve your strategy.

Conclusion

Forex scalping can be a highly profitable strategy when done correctly. However, it requires discipline, patience, and the right set of tools. As a beginner, it’s important to focus on developing a solid scalping strategy, understanding the tools and indicators, and managing risks effectively. By following a proven strategy and avoiding common mistakes such as overtrading or neglecting risk management, you can increase your chances of success in Forex scalping.

Remember, success in Forex scalping doesn’t happen overnight. It takes practice and continuous learning to master the skill. Focus on improving your trading psychology, consistently following your plan, and always adapting to market changes. With the right approach, scalping can become a consistent and profitable trading method for beginners and experienced traders alike.

Read more Forex Trading Risk Management Techniques

Frequently Asked Questions

What is the best time to practice Forex scalping?

The best time for Forex scalping is during periods of high liquidity and market activity. This typically happens during the overlap of the London and New York sessions, usually from 8 AM to 12 PM (EST). These hours provide higher volatility and tighter spreads, making them ideal for scalping.

Can I start scalping with a small capital?

Yes, you can start Forex scalping with a small capital, but you should adjust your position size and risk management strategies accordingly. Since scalping involves making multiple small trades, it’s important to ensure you can cover transaction costs while managing risk effectively with smaller lot sizes.

Do I need to use many indicators for Forex scalping?

No, using too many indicators can create confusion and lead to analysis paralysis. Effective scalping relies on a few reliable indicators that complement each other. For beginners, focus on simple indicators like moving averages, RSI, and Bollinger Bands.

Is Forex scalping suitable for beginners?

While Forex scalping can be profitable, it requires quick decision-making, and the ability to handle emotions and stress. Beginners should first practice on a demo account to get familiar with the speed and complexity of scalping. Once they gain more experience, they can start live trading with small amounts.